http://thegreatrecession.info/blog/

![Tropenmuseum, part of the National Museum of World Cultures [CC BY-SA 3.0 (https://creativecommons.org/licenses/by-sa/3.0)]](http://thegreatrecession.info/blog/wp-content/uploads/Caterpillar-500x351.jpg)

This Cat apparently does have nine lives, and it’s already used seven of them. After six consecutive quarters in which Caterpillar’s earnings failed to meet plummeting expectations, Cat’s stock started to die each time then took a dead-cat bounce back to life. After its seventh quarterly fail in October, it only climbed higher.

Yet, no one even muses about that here in Wonderland where everything that goes down must come up. On October 23rd, when Caterpillar issued its third-quarter report, you would have thought Cat sales were maintaining a slow uphill crawl when, in fact, the big Cat was sliding downhill faster than the avalanching ground around it. Likewise, in the days thereafter as people digested the all-bad news, you would have thought the report was stellar:

Behind strong returns for shares of Intel and Caterpillar, the Dow Jones Industrial Average is up Friday afternoon….

MarketWatch

Two days after its dismal report, Caterpillar and Intel contributed 25% to the market’s intraday rally. Yet, Caterpillar’s earnings were absolutely abysmal. It even slashed its forward outlook — again — due to deteriorating global growth prospects. Its reported earnings per share at $2.66 came in below grade from expectations of $2.87 that were already lowered due by the previous quarter’s of lowering forward guidance. Its revenue mired down at $12.8 billion versus the already swampy expectations of $13.4 billion. Year-on-year, revenue was down 6%. (Profit per share down 8%, and that was after $1.8 billion in share buybacks — a 7% shrinkage in outstanding shares!) But it’s stock climbed almost vertically.

The huge misses could not even entirely be blamed on Trump’s Trade Wars. Cat sales were down across the globe, not just in the US and China. In the US they were down largely due to the slowdown in shale oil; i.e., particularly fracking. (Oil-and-gas-related revenue sank 9%.) Sales related to construction businesses were also way down in the US (7% YoY). Mining equipment down 12%.

Only days before, the giant machinery company’s stock had been downgraded by Morgan Stanley who thought the “industrial economy might be running out of steam.” The heavy Cat’s ability days later to defy gravity and levitate up the downgrade provided a clear exhibit of how permabulls can strain positives out of nothingness as MarketWatch generously reported,

Results from Caterpillar Inc. CAT, +1.24% and Boeing Co. BA, +1.11% initially knocked the market lower in pre-market action on Wednesday, but stocks turned higher in early trading as investors took positives away from quarterly results from the blue-chip components.

MarketWatch

They took positives because the financial media chose to feast on flights of Cat fancy. The actual positives must have been undiscoverable because even MarketWatch appeared unable to name any, as its article reported no actual positives:

Caterpillar missed both earnings and revenue estimates and cut its full-year 2019 earnings outlook. Boeing reported a 50% earnings slide that badly missed estimates and a revenue slide of 20% or less than expected, but also upheld its forecast for its 737 Max airliner, grounded since March, to return to service later this year. Caterpillar shares rose 1.2%, while Boeing’s stock added 1%.

That’s positive? With such deeply plagued news, no wonder their stocks soared. Why would they do otherwise in Wonderland?

Boeing did its usual blah, blah, blah and said things will be flying again as soon as a vague “later” this year? And that was all the market needed — just a little jaw-boning in the midst of a total lack of supporting facts, and up the market soared. Cat didn’t even attempt the lip service. Who knew heavy equipment could fly on something thinner than hot air, which Cat didn’t even attempt? The Cat flew on the wings of hope.

“The earnings bar was set very low for the third quarter and it’s been predictably easy for companies to step over it,” Michael Arone, chief market strategist at State Street Global Advisors told MarketWatch. “The market reacted with a bit of mixed emotions with these earnings

Yeah, the earnings bar was set so low it was sub-grade; yet Cat sales, revenue and earnings couldn’t even climb over that. But its stock, like Boeing’s, easily flew high above the bar.

Why?

Supposedly because …

investors looked past some weak earnings due to the expectation of a trade resolution.

Oh. Let’s ignore the caterwauling we hear directly from Caterpillar about how badly it is doing and just go with the phantom fantasy that has failed to materialized since the trade war began a year and a half ago. Fantasy over facts. And let’s ignore the fact that all reports about this ever-evasive fantasy say that it will do nothing to get rid of tariffs already in existence, but will only prohibit new tariffs, which clearly means business will not get better. (Not that any past deal, such as with Mexico, has ever kept Trump from instating new tariffs over other matters.)

Putting the fantasy aside, the real facts sized up like this:

For companies that have fallen short of expectations, the magnitude of misses have been great. During October, blended earnings growth, which combines actual earnings results with projections for companies that have yet to report, has fallen from a 3% contraction to a 4.7% contraction, according to FactSet data.

But the facts of how we did are no longer important in the world in which we now live. What matters is the hope. What matters is that we hear what we want to hear, even if such lofty words run completely contrary to all known facts on the ground.

How we did this quarter isn’t as important as what we expect the future to hold.

How we did this quarter all across the stock board was, at best, meeting low expectations and, at worst, falling far below them. Since that’s bad news, the market ignored it. And the prognosticators, instead of writing about the “things we hope for” write about “the expectation of.” How did Trump’s words about a trade deal rise from a mere hope to an “expectation” among market commentators? The talking heads worded it as an “expectation,” even though companies like Cat said not to expect anything of the kind or even hope for it. Even though the constant failure of Trump’s hopes to materialize should lead us to expect they won’t. Most of companies actually said they “expected” the market to remain bad.

Oh, and then there was this as a possible reason these stocks climbed:

The Fed announced earlier this month it will purchase more $60 billion a month in Treasury bills to prevent liquidity crunches that took place earlier this year and is also expected to cut interest rates for a third time this year next week.

That might have had something to do with it.

The laughable part (laughable like a hyena) came in statements like this:

“Investors have been more concerned about slowing growth, which is reasonable, but I think there’s been an overdose of pessimism about how resilient consumers are,” said Kate Warne.

Concerned? Where? Investors were leaping for the chance to bid up the stock of a company that actually broke its toe on a bar buried in the ground. Pessimistic about how resilient consumers are? Are you kidding me? All I’ve heard throughout the mainstream media since the middle of this summer is how the ongoing manufacturing recession (and now developing services recession) didn’t matter at all because consumers were saving the economy and showed no sign they were about to slow down.

Somebody must have breathed a hint somewhere that consumer sentiment might turn at some point, so poor Kate warned us about this extreme pessimistism. After all, anything that is not cheery should be shunned in favor of candied fantasies around Halloween.

As if Kate Warne’s statement wasn’t bizarre enough, contrary to all evidence, she leaned in even harder on it:

She pointed out that third-quarter earnings have a tough year-over-year comparison, since last year corporations got a boost from the late-2017 tax cuts. From that perspective, results that are slightly better than expected is solid, the strategist said.

Ohhh. Poor third-quarter earnings. We should go easy on them then. The truthful way to say that (which no one did last year) was that last year’s seemingly good earnings were all a mirage caused by tax reductions because earnings-per-share are after-tax reports. Earnings, as I pointed out last year, actually sucked, but they looked like they were doing O.K. solely because a huge tax cost was taken out of the bottom line. Business sank, but reported earnings grew.

This year, however, reporters and analysts are comfortable stating the truth they wouldn’t tell last year about earnings being buoyed by tax cuts alone, because they can use those same tax breaks now to excuse how bad this year looks in year-on-year numb ers. Last year, when the tax cuts positively impacted year-on-year earnings reports, the cuts were almost completely ignored in most financial reporting to keep things sounding as rosy as possible. This year, they are talked about to make things sound as rosy as possible again.

Kate Warne puts a shine on it all this way:

“In an environment of job growth, ultra-low interest rates and central-bank stimulus, this is actually an okay environment and one in which you need to be putting money into stocks because they can continue to go higher,” she said.

In other words, business stinks, so we won’t even talk about it. Ignore, also, whatever businesses say they believe is going to happen in the fourth quarter, and focus on everything that has nothing to do with actual business in order to strain out the few remaining positives you can find — especially those incoming free Fed funds.

The greater truth that you should get out of what Caterpillar reported on October 23rd was …

Caterpillar produces so much of the world’s equipment that a decline in its business often indicates a broader slowdown in construction and factory activity. Weaker demand for its products typically means people are building and manufacturing less, which doesn’t bode well for global economic growth…. “In the fourth quarter, we now expect end-user demand to be flat and dealers to make further inventory reductions due to global economic uncertainty.”

Business Insider

That should have been the takeaway from Cat’s own words, but it wasn’t.

Caterpillar’s shares climbed 0.7% in early trading on Wednesday.

Sure. Why not?

One week later …

CAT stock is up 12% in the last month to crush the S&P 500’s 2.2% movement. In fact, the company’s shares have jumped nearly 6% since it posted its quarterly results on October 23…. Shares of CAT closed regular trading Tuesday up 0.91%,… not too far off its 52-week highs. The company’s stock price is now up 20.5% in the last 12 months…. CAT stock is also up well above both its 50 and 200-day moving averages, for those who pay attention to technicals, thanks to its recent climb.

Yahoo!

Sure. Why not?

And that … in spite of the fact that …

Current Zacks Consensus Estimates call for the company’s fourth quarter sales to slip 4.6% to hit $13.69 billion…. Peeking further ahead, Caterpillar’s Q1 fiscal 2020 sales are expected to fall 6.4%.

Lesson to be learned: In order to get your stock to rise …

- Lower expectations;

- trip over that low bar by reporting revenue and earnings per share far below those expectations even after large stock buybacks; and then

- lower expectations even further for the upcoming quarter because you believe the global economy is declining.

How do you get your stock to rise when reporting all of that and get people to strain out a grain of sugar from a heap of mud?

During the earnings call, CEO Jim Umpleby said Caterpillar expected to increase the dividend by high single-digit percentages in each of the next four years.

The Motley Fool

And how do you manage to raise dividends when sales and revenue are crashing so badly and when you foresee that decline as continuing to the horizon? Simple:

Bonfield also noted on the call that Caterpillar had issued $1.5 billion worth of debt in the quarter “at attractive interest rates”

Pay your other expenses by taking out loans made cheap by the Fed’s renewed manipulation of financial markets in order to keep enough free cash flow to actually increase dividends to shareholders even as your profits decline badly (even though the idea of dividends has ordinarily been that they are shareholder’s percentage of profits).

It doesn’t matter if your business and profits are declining so long as you can leverage your capital for loans. Milk the business for all you can by using it as a loan vehicle. The Motley Fool recommends buying because business is down so dividends are going up to keep investors in. Never mind that …

two out of the three machinery segments (Caterpillar also has a financial product arm) reported declines. Bonfield put that down to “greater-than-expected reduction in dealer orders in the third quarter and the shift down in anticipated end-user demand.”

Who cares? The financial-product arm was apparently doing fine. Building machinery it turns out is really just about building collateral you can take loans against by appearing to be in business.

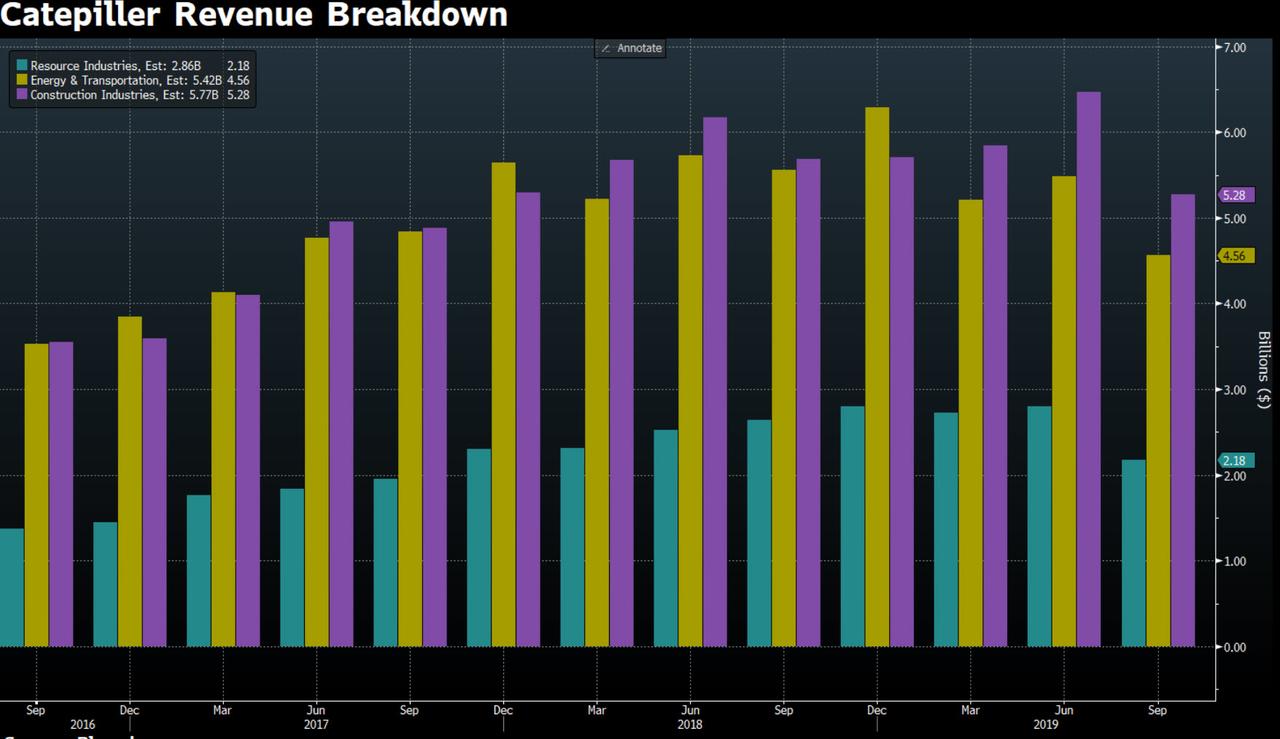

So long as your past year of business looks like the year shown in the last half of this graph, things should go well:

Just maintain the illusion that you are still actually still in business, and all should be fine.

(Glad that wasn’t my hospital chart.)

Apparently, the following call at the start of October was prescient:

“Caterpillar Stock Is Ready to Start Purring”

Investor Place

Someone must have had insider knowledge that Caterpillar sales, revenue and profits would all be substantially down, making the stock a sure bet ahead of reporting. They ought to be investigated. Analysts at FactSet, for inexplicable reasons, actually expected Cat’s earnings to rise; but Investor Place must have known they would fall so stocks would, of course, rise because that is how Wonderland works.

What Cat has really become a bellwether for is how ridiculously disconnected from business reality markets have become. The downside to ignoring reality, however, is that eventually it rolls over you.

Well, keep on tracking….