Is coming up with a Trump tax plan overtaxing the maestro of negotiation as he tries to conduct his way through congress? An initial clue can be found in his tax-related repeal of Obamacare. The all-important Obamacare repeal got repealed by Paul Ryan — the very person who proposed it — in a matter of days. Who could have guessed reforming healthcare could be so hard? (Everyone but Trump?)

Is coming up with a Trump tax plan overtaxing the maestro of negotiation as he tries to conduct his way through congress? An initial clue can be found in his tax-related repeal of Obamacare. The all-important Obamacare repeal got repealed by Paul Ryan — the very person who proposed it — in a matter of days. Who could have guessed reforming healthcare could be so hard? (Everyone but Trump?)“We learned something,” Trump said defensively. No. TRUMP learned something. Never did I think reforming Obamacare would be the hundred-day slam-dunk that Trump promised over and over. (Now, he’s trying with Obamacare again, after warning Republicans in read-my-lips style that he wouldn’t … but without a lot of evidence of progress.)

There is this thing called “congress,” President Trump, and you’re stuck with it. Sad to hear you are learning that on the job — sad for all of us — but that’s the way it is with people who endlessly shoot their mouths off with a lot of (apparently) hot air about all they’re going to do and how great it will be. They are almost always bigger on talk than they are on delivery.

Because Trump has zero influence with congress, the maestro of negotiation has been doing most of his work by decree, rather than by negotiation. Even that has, as I warned in my articles about euphoria in the stock market, largely failed. (My claim having been that the Trump Rally is continually in peril because it is built on imagination of what will happen.)

Where Trump has done what he promised, he’s largely failed so far, and where he is succeeding it is by doing the opposite of what he promised. To wit, President Trump’s first decree issued on his first day in office in order to look like rapid progress was a hiring freeze on all federal government offices.

It made for nice show and tell, which Trump loves, but government turned out to need those new people, and so government work started backing up badly in departments that Trump likes, such as Veteran’s Affairs. Prisons started running short on guards. The backlog of work that wasn’t getting done became so bad in less than Trump’s first hundred days, that the president lifted the hiring freeze this month even though none of the restructuring that was supposed to have been planned during the freeze has taken place.

The word that’s out says that making those staffing cuts will take more time … maybe a lot more time. Team Trump is now postulating savings will be seen in the 2019 budget! (Do we ever see savings that far out actually materialize? The savings are always promised to happen in the days of a new congress that will decide for itself what is going to be cut, thanks.) Who could have guessed reforming government would be so hard, right? When the reform does happen, though, “it’s going to be a beautiful thing.”

Then there was the travel ban, done in a ham-fisted manner that created momentary chaos and alarm, though it has gone nowhere since then.

So far, the few areas where Trump has actually attempted to do what he said he would do have either failed to work out at all, or they have certainly not worked out “great,” as promised. It is not those total failures or tilting successes that bother me, given that we don’t even reach the close of his first hundred days until the end of this week, so much as it is all the areas in which Trump has completely reversed himself. (See the lead article in this series: “You Got Trumped! Winning horse in presidential race was Trojan.”)

Trump Tax Plan bounces around on the Trumpoline

The Trump Tax Plan is one of the areas where Trump has not quite reversed himself and seems to be trying to do what he said he would, but he also seems to be bounding all over the place. Today, we are promised we will finally see progress on a Trump Tax Plan, but the faltering has already been considerable:

This new Trump Tax Plan will be Trump’s fourth tax plan in one year. The flaws in the first plan, which he put up during his candidacy, were so roundly ridiculed and beyond argumentative support, that Trump trashed that plan and came up with a new plan while he was still just a candidate. After he was elected, he had Larry Kudlow, the idiot, and Steven Moore build out the new plan into a new, new Trump Tax Plan. Now that he’s been inaugurated, he’s also trashed Kudlow plan or is substantially revising it by having his Goldman-Sachs boys come up with something else.

I have no problem with trashing the Kudlow plan because I think capital-gains tax breaks are stupid anyway. Why give the people who work the least and make the most the biggest breaks just so they can go speculate their savings back into pumping up an over-pumped stock market? (And why on earth would they invest that money in factories when the savings are in capital gains, and the fastest way to those are through buying and selling stocks, not building factories?)

However, even Trump’s big tax planners are wondering what is taking so long:

Larry Kudlow, a veteran economist who advised Trump’s campaign, expressed dismay that the president hadn’t yet released a tax plan. He said he was beginning to wonder whether the president is about to walk back his pledge to cut taxes. “What is their product?” Kudlow asked. “It doesn’t make any sense to me. I’m not giving up hope. But it’s looking very shaky to me.” (Politico)

Michael Moore, who partnered with Kudlow on crafting the president’s previous tax plan, said,

They’re all over the map. I don’t know if they’re listening or not.

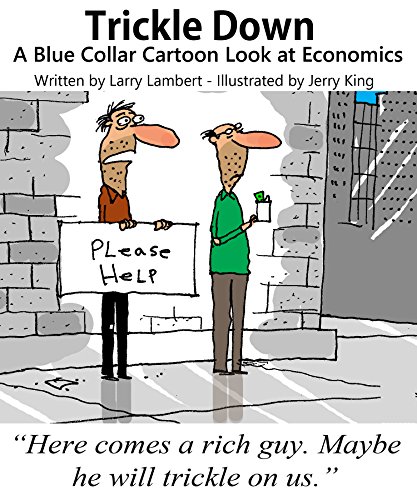

Hopefully, they’re not listening to Crazy Larry or Mister Moore because the new, new Trump Tax Plan was an idiotic return to trickle-down economics, which has never worked as promised, as I wrote about in an article titled “Trump Tax Plan Turns the Donald into Trickle-Down King.” So, while it may be good for Trump to take more time and revisit this, his refusal to put that plan forward also indicates I was right in that article to criticize the plan. It was another mistake caused by putting, as I wrote then, total establishment shills in charge of the new, new tax plan. (Whether Trump will come up with anything better now remains to be seen later in the day.)

None of these plans have yet made it to congressional debate, and the necessary delay makes me wonder if Trump’s pivot back to working covertly on Obamacare Repeal II — even after he boldly warned the Republicans that the last repeal act was their only chance this year — was because he needs to stall for time for Gary Cohn and Steven Mnuchin, the former Goldman-Sachs Execs. to come up with a new master plan. Hence Kudlow and Moore profess to being in the dark about what is happening because Trump is ditching that plan and doesn’t want more input from them. That would explain why Trump keeps saying its essential to work out Obamacare first. (Let’s watch to see if Obamacare comes to another failure once the new tax plan is released.)

Trumpeting the Trump Tax Plan

Clearly, Trump is not a leader with ideas of his own. He has built his reputation and his candidacy by blowing his own horn as great leader because he hires the best and the brightest and right people to do the job. Apparently, he failed on that, or we would have received the Kudlow-Moore tax plan. I’m equally concerned about the next people he has chosen to create his fourth tax plan. I don’t trust GS executives to come up with a tax plan that is good for the little guy and the middle guy. Cohn claims his completely new plan will focus on the Middle Class (meaning it won’t just be trickle-down where you hope to catch the drips that slip through the fingers of the wealthy). Great if it does, but that will surprise me.

The point for this article is not whether the Cohn plan will be better than the Kudlow plan, but that Trump is massively switching all over the place all the time and putting the wrong people in charge. That’s what people do who sailed in as the anti-establishment champion once the mighty establishment goes into its brilliantly smooth mode of remaking them and grooming them.

Trump knows the clock is not on his side when it comes to his stock rally holding, given that it’s been slipping impatiently the entire time he’s been redrafting his fourth plan, so he wouldn’t start over from with Cohn unless he either came to see that the Kudlow plan was a disaster (as the congressional accounting office said it was) or his Goldman Boys wanted something different. (The market’s spike back up in the last few days has nothing to do with Trump and everything to do with France.)

To buy more time, Trump promised us, exactly as he said in advance of the Kudlow plan, that he’ll be coming out with a great plan on Wednesday … “or a little later.” So here we are, but remember that Mnuchin once said he hoped to get his plan all the way through congressional approval by August? That has now been revised to his saying he hopes they will get it passed by the end of the year. Remember that Trump’s original big promise was to have a complete overhaul of the the tax system before congress within his first two or three weeks in office. Time keeps on slipping….

If the plan does make it out today, let’s hope this new, new, New Trump Tax Plan is greater than all the previous great plans because the law of diminishing returns is rapidly applying to Trump’s mouth. His announcement last week that the new, new, new plan will be “the biggest tax break ever” got only a whimper of a rise out of the stock market.

Even the euphoric Wall St. Casino seems to be getting weary of big talk with no delivery. (Perhaps that is the true significance of a big mouth with small hands.) It would be better to follow the Teddy Roosevelt principal of small talk and big delivery where your words gain power over time, rather than lose power because people get used to your delivering less than you promise … or nothing at all. Trump is losing power because he over-promises and under-delivers. That usually is the downside to a lot of bragging.

Is tax triage about to begin in order to save the Trump Tax Plan?

The next few days should be telling. Two months ago, I warned,

Where we will start to get into trouble is if the red meat Trump offered to stockholders in the form of mountains of tax breaks starts to fade toward a more distant horizon. Then his red-hot tongue may become the dominant market influence. The market may stop breathing helium and floating ever higher…. Things [will] start drifting downward unless we start seeing accomplishments on taxes, infrastructure and Obamacare.

Trump has huge opposition even within his own party, so “divide and conquer” leaves all democrats and half the Republicans against him. [Trump’s divide and conquer] will not likely put any meat on the table in the next year or two (in terms of either his infrastructure stimulus plan or his tax plan). Trump’s tax changes may simply come too late to save the deeply flawed economy from its own more deeply flawed recovery.(“Will Trump’s Talk Turn the Trump Rally into Lasting Gold or End in the Trump Dump?”)

So far, that is what we are seeing as the date for anticipated approval moved to the end of this year, and the market started to cool. Many were hoping something would be in place in the first half of the year. Even the tax planners were dismayed by the delays of their brilliant craftsmanship.

A few days later, I wrote,

The euphoric rise of the US stock market has formed almost entirely from speculation about Trump’s tax cuts and infrastructure spending, so it is likely to lose steam now that postponement of those plans shows sentiment outpaced reality. (“2017 Economic Forecast: Global Headwinds Look Like Mother of All Storms“)

While I still believe, as I did in January, that Trump will get some form of tax reduction in place this year, I’ve said all along that the market is irrational for banking up so high because it will all be too little too late to save the Fed’s failing recovery. I would expect, if Trump’s plan today contains enough red meat for the market dogs, that the rally will resume for a short time. If Trump fails to deliver a plan, it will start to fall again. If the red meat does get thrown to the dogs in congress, it will get chewed up, and the dog fight will give plenty of time and reason for the market to falter again … and again.

Consider how the Obamacare repeal failed because only a few people developed the plan while keeping it out of view of most Republicans who would have to vote for it until the last minute. That wasn’t exactly the masterful negotiation about which the maestro has long blown his horn. It was more of a pathetic cacophony. That same strategy has been used for the new, new, new tax plan. So, why expect different results? The Senate panel that will have to vote on it just to get it before the entire senate was only given a peak yesterday.

Let the wild ruckus begin!

Already, we are being told that the border-adjustment tax has been removed in order to help the plan get through congress, and we learned in the last few days that the separate spending bill for this year, which must happen by the end of the week, will include no funding for a border wall. Trump merely used the border wall as a negotiation chip, and said he may bring it up again in September. As what? A handy chip to be used again?

So, in the very least, this tax and budget negotiation is showing us that changes at the border are taking a back seat, even though those are the things Trump talked about most. And that kind of give-and-take that is essential to negotiation demonstrates why I’ve said the market rally was nothing but irrational exuberance. There will be many months in finding out what survives negotiation, and Obamacare demonstrated that the maestro may be a little tone-deaf when it comes to conducting his score before congress.

It’s too early to actually say you got Trumped with the Trump Tax Plan (by a few hours perhaps), but it’s been a bouncy path trying to get to a plan and slower than Trump promised. So far, every Trump plan has included a large capital-gain tax cut, and one thing is certain about that kind of cut: it will never trickle down to you unless you make most of your money speculating in stocks, bonds, and real estate, but it will make a LOT of money for real-estate developers like Donald Trump.

Supply-side tax cuts are the biggest reason the rich have gotten so much richer while the middle class has dwindled. If Cohn is true to his word about retargeting the new, new, New Trump Tax Plan to help the middle class, the new plan will contain no special tax rate for capital-gains income, treating it equally with everyone else’s class of income; but it’s hard to believe a Goldman boy would not include a lovely cap-gains tax cut for the people in his world with some candy thrown in for the middle class to win their approval.

(If the plan does come out today as promised, I may add an addendum to this article on my own blog, so check the version of the article on the blog later to see where the end of the day takes us. Maybe I’ll have to recant some things, or maybe the next cacophony will begin. I decided not to wait and see what comes before publishing this because it is much more fun to step out on a limb. You can watch me saw off the limb I’m standing on if the new, new New Trump Tax Plan turns out to be a masterplan for the middleman. I hope I’m wrong. My guess is that the best we’ll see, given all the delays so far, is a general synopsis of where the plan is going, but we won’t see a detailed plan that congress can start working on.)

UPDATE ON THE TRUMP TAX PLAN:

The big announcement of the really, really big Trump Tax Plan has happened, and the stock market has closed for today, and … there is clearly nothing to recant. Some news organizations, getting a little ahead of themselves, talked about the US stock market taking off because of the Trump Tax Plan:

Once again, investors appear to be placing the bet that Good Donald Trump will be great for the market and that Bad Trump won’t be all that horrible. That was on display on Tuesday. The Dow Jones Industrial Average soared more than 230 points after it was reported that the White House’s tax plan, whose broad outlines will be announced on Wednesday, will propose cutting corporate tax rates to 15 percent, a Trump campaign pledge that many thought the president was backing away from. (Newsmax)

Ah, but that was then, and this is now — a couple hours later — by which time the market tanked as steeply as it rose (and twice as far) to finish the day with the Dow slightly down from its pre-tax open — a sign of a mercurial market that was, for an instant pleased, until it started to feel a little indigestion from consuming its dinner too quickly. At that point, it barfed up all its gains for the day and went to bed sour.

What the White House billed in its release as “the biggest tax cut in history” rapidly turned into digestive gas. In other words, “Nothing to see here, folks. Go home.” As I speculated above, no real plan was released. Just gas. Once again the Trumpet blew his horn loudly (probably from his back side) about the big plan finally being released, and then his team turned out a summary statement, devoid of any details or calculations.

Here is my own summary of the Great Trump Tax Plan:

- The plan will eliminate estate taxes, which only the wealthiest Americans now play, helping Trump and family considerably in the future, but most of you not one iota. (This is a cut 100% for the rich, but it makes things equitable.)

- The White House compensates for this by saying some other tax breaks that help the rich will be eliminated so that the plan would largely help the middle class; only, as usual, it doesn’t specify what those “other” current tax breaks are that will be eliminated. (So, read that as, “Just trust us on this one.”)

- The new, new New Trump Tax Plan contains no math to show how much of a deficit the new plan will create, but co-creator Cohn offers assurances that the tax cuts “will pay for themselves” through economic growth and that the president knows we have to “be good stewards.” (“Just trust us on that one.”)

- The plan comes with Cohn’s personal assurance that the president “will get this done for the American people.” (I feel better knowing that assurance is still being offered as it was in past months. I do note, though, that missing their stated and revised schedules during those months now leaves them simply assuring us it will still get down, but without anymore undoable deadlines.)

- Corporate taxes will fall from 36.9% to 15%. (That will include closely held businesses and limited partnerships, like legal firms, construction companies in the oil industry, and … real-estate companies, where business income largely passes through to the owners (sometimes the family) so the business does not pay the tax but the owner does when the money passes through. (In other words, the bulk of Trump’s income tax — and his children’s — will drop from 35% to 15%, except that the plan comes with a footnote that this will be done in such a way as to insure that wealthy Americans do not exploit the change. So, we’re good!)

- The plan reduces the number of tax brackets to three simple levels (10, 25, and 35 percent), and states the tax rate of each bracket. (Unfortunately, it omits stating what income levels will apply to each bracket.)

- The plan comes with a note that details will be hashed out with the House of Representatives and the Senate in coming weeks. (Maybe months? Like the Obamacare repeal details got hashed out … of existence?)

- “We know this is difficult,” Cohn said. “We know what we’re asking for is a big bite.” (That’s a plus because with Obamacare, “who could have thought it would be this difficult?” At least, now they’ve learned it is difficult. They have learned something on the job, so we can feel good about having a smarter team.)

- It does help some of the middle-class by doubling the standard deduction for married couples, and it maintains the allowance for charitable deductions, and it says it will allow tax relief for childcare expenses (though, again, without any details).

- The plan promises to alienate anyone who lives in a state with high state income tax by making state income tax no longer deductible. (No help if you’re not in such a state, and a bite in the butt if you are; but the plan softens this news by noting that this effects higher income people the most — well, yeah, the ones unlike Romney and Trump who have been known to pay no state income tax.)

- The plan simplifies tax code (albeit it doesn’t tell us how, just that it WILL). This will presumably happens when congress actually sits down to create the plan with laws under Trump’s instruction that the laws be more simple. (Trust us on that one, even though everything we’ve simplified so far has been ruled unconstitutional in a court of law or died in debate.)

- Repatriated corporate profits will get a one-time major tax reduction, but all profits made overseas after that will be completely tax free for years to come! (That’s a glory-hallelujah! Well, except for the detail that the tax rate for repatriation is omitted. But, hey, at least they’re thinking about it! And they’re gonna do something! Those cuts will be the “biggest in history!” We just don’t get to know how big until they figure that out. Details.)

- One thing that is NOT mentioned in the new, new, New Trump Tax Plan is capital gains tax. If the lack of mention means there will no longer be a special capital-gains tax rate, the elimination of that gift, which goes largely to rich stock and real-estate speculators who can pay to play in that realm, is something I will like. (But the plan doesn’t say one way or another, and you can be sure Republicans will insist on putting that objectionable trickle-down part in as details are “hashed out.”)

Fine print: “details to be determined.”

Wouldn’t you know it? The one part where the devil always rests is still hidden under a sheet to be revealed at a later date.

Written on all of one side of one page, the new, new, New Trump Tax plan looks like a scheme worked out by a couple of guys in a paneled club room, smoking cigars over whisky on the rocks and deciding what sounds “great.” Maybe that’s why the US stock market plunged once the cigar smoke cleared so investors could actually see the new, new, New Trump Tax Plan … and the napkin it was written on. How pathetic is the plan when it gives the “biggest tax cuts in history” all aimed at pumping up the stock market, and all that accomplishes is to cause the stock market to slump in disappointment? Talk about an anti-climax.

I think Trump announced, “We’re going to present our tax plan on Wednesday,” and his two tax boys said, “Yikes, we better get the plan laid out. Let’s meet tonight after work for drinks and draw something up, and then we’ll give it one of our secretaries to make it look nice.”

Where we got Trumped on this plan was in thinking a plan might actually be coming out today!

Hah! Silly us! It’s more of a promissory note, really. I’ve seen footnotes larger than the plan. What we got today was, again, nothing more than just talk! Talk about what they WILL do … someday. They’ve managed to finish a one-page outline. I think the market rose when it heard general statements about the plan, then plunged all the way to closing when it saw that it was written in large print on one page and that general statements are all there is. Great work for your first hundred days, Boys!

Called that one! If there is anything that has gotten to be predictable about Trump, it’s that he’s all talk all the time. He’s appropriately named for his loud and brassy mouth. Now, if he can just get his band of merry boys to orchestrate a tune. Trump promised the plan would be beautiful, and it is that; it’s written on a lovely piece of paper — very high quality like the menu at Mar-A-Lago, in a very attractive font that can be comfortably read from a distance. It’s a thing of beauty. You should see it. Really, you should see it. I think it even has a picture of chocolate cake on it!