http://thegreatrecession.info/blog

That didn’t take long. Just a month ago, I wrote, “Stock Market More Overpriced and Perilous Than Anytime in History,” stating that the market was poised for a big fall because “some of the market’s most fundamental valuation metrics are now printing at levels never seen before…. This market is tripping on some pricy hallucinogens.”

[Note: I’ve added an end-of-day update to this article that makes all the facts you read below — which I already thought was a major market blow out — a mere setting of the table.]

And here we are! A single black swan has knocked the legs out from under the bull. It’s not a full-blown correction yet (requiring indices fall by, at least, 10%) or a crash (20% or more), though it looks like it could hit that mark by the end of today. That would be a full correction in just four days.

The market has fallen off such a steep cliff to where MarketWatch reported that Monday and Tuesday teamed up to be the largest two-day point drop in Dow history! (Some other sites have said it is the largest since the big drop I predicted for the start of 2018 when the market experienced its largest one-day point drop in history.)

My warning in the article referenced above was,

Don’t let marketeers influence you with their claims that the market is going to rise this year. You can bet that every single one of them, if alive in 2000, was saying the same thing then, too.

And now the headline this morning at MarketWatch is “Here’s why tech stocks could be on the verge of a 2000-style meltdown.”

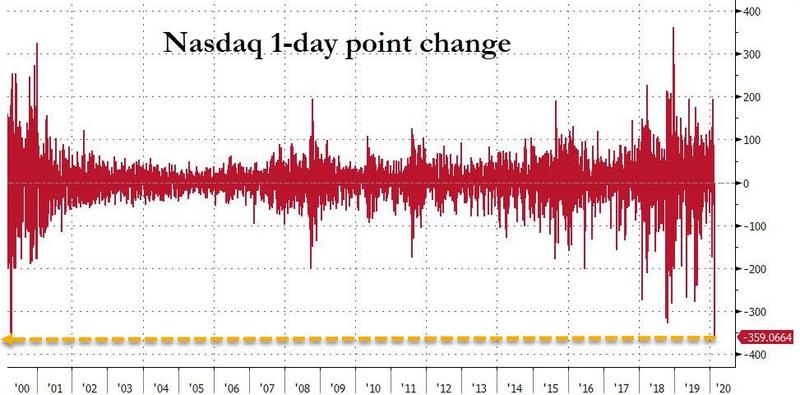

Clearly the drop taken in just the first three days is even worse than anything we saw back in 2018:

In fact, the one-day plunge in the Nasdaq at the start of this cliff-dive can only be matched by going back to the high-tech dot-com bust:

Charlie McElligott of Nomura called the past three days “the largest cumulative 3d deterioration of US financial conditions since the Dec ’18 Fed QT panic” and says that we were already in an “end-of-cycle slowdown careening into outright recession panic … last year.”

Even a lot of the usual happy-faced financial experts (market promoters) are saying “sell the rip,” not “buy the dip any” longer. And it all happened just as mom and pop went on a big stock spending spree:

(Who could have seen that coming? Isn’t that how I’ve said these boom cycles always ends — with the little guys holding the empty bag?)

Some will say this is just because of a feared illness going around. I can easily call bunk on that with the chart below:

As you can see above, strong bull markets and robust economies do not fall all apart in what looks like sheer panic (in terms of historic scale) over a viral scare in another nation. there is no past evidence of any major dive due to a virus, and it is not as if ebola and MERS and SAARS were not just as scarily as this virus.

This big face flop of the bull reveals how perilously this market was perched. As I argued in the referenced article, when there is no fundamental economic support, things can fall long and fast and hard. And that is what they just did.

In terms of interesting little stats to back that up, Zero Hedge reported,

This is the first time the S&P 500 closed down more than 2.5% for consecutive sessions while above its 200-day moving average for the first time since 1938.

That’s a hard drop!

Granted, as I pointed out in another article over the weekend, the economic damage from the fear over COVID-19 is already significant. So, the market has plenty of economic reason now to fall. It had plenty before, but this is a sudden spear in the heart.

Yet, the health damage is, so far, not that severe, even in comparison to the flu. Give that statement a little time to age, and we’ll see how it does. By the end of summer, I doubt most of us will know more than one or two people, at most, who got the disease this year and probably none who died of it. (I hope.)

That is what makes the present economic crisis all the more telling about the supposed strength of the economy and particularly of the prior foolishness of market bulls who believed they could fly to the moon. The cow may have once jumped over it, but the bulls aren’t going to. Economic gravity still works, and my argument has been that the higher the market rises above its 200-day moving average and above its trend line and above the general economy, the greater will be its fall when a single event comes and kicks its legs out from under it.

Saxo Bank, a Danish investment bank, summed up the market’s foolishness this way:

The market flipped very suddenly from outright complacency to all out panic and risk assets were offered across the board as investors woke up to the realities of what has clearly been a huge mispricing of risk…. As investors have reassessed the real impact of COVID-19, the simultaneous unwind in positioning has been violent, given the complacent positioning prior to the sell off and the increasingly stretched valuations which left the market over extended and vulnerable to larger falls as positioning flipped.… No doubt the pandemic fears are a catalyst, but is difficult to attribute what proportion of the move is due to extreme complacency being upended vs. the virus spread…. That being said, the S&P 500 is not oversold, despite the violent price action over the last few days, and there is capacity for a continued corrective move…. The state of play is currently unprecedented.

Zero Hedge

Saxo Bank also referred to the market as “detached from fundamentals” because the rampaging bullheaded herd has been accustomed to central banks caving to liquidity demands; but central banks cannot fix broken supply chains or public fear — not likely anyway. It was always a mistake to think the Fed can save the market from anything.

The disruptions to supply chains … will be larger than most analysts have forecast to date, and the corresponding recovery will be increasingly protracted.

What I am glad to see in Saxo’s comments is that even a major investment bank recognizes the real problem was in the market’s underpinnings, not in the virus. Nothing can support a market of drinking bulls, floating in a delirium, when doused with a wave of fear.

Saxo Bank continued,

The spread of COVID-19 beyond China now means more transparent reporting from countries like South Korea, Croatia, Switzerland, Spain, Austria and Italy which could further heighten volatility and risk aversion.

True, except that more transparent reporting is consistently showing that the COVID-19’s death rate is only doubt that of the common flu, taking out mostly those who were already on their deathbeds (like our economy); and still the market keeps falling. (In fact, death rates typically decline as more becomes known about a disease so it becomes easier to diagnose and as treatments emerge. In the early stages, only the worst cases are caught and reported.)

It is only a matter of time before cases are reported in the US, a potential trigger for another wave of selling.

My apparently bland comparison of the disease to the flu doesn’t mean fear of the disease is not hugely disruptive to the global economy as I last reported. And to a delirious stock market. That will make it easy to blame the virus for the whole thing, so I suspect Saxo’s clear thinking on this will soon get lost in all the coverage about the virus being the reason the economy finally crumbles (the rest of the way) to the ground.

And I’m not saying the disease isn’t horrible, even if it may turn out to be not much worse than the flu. I sure don’t want to get it or make light of anyone who does. The common flu has been known to give me pneumonia and make me sick for four months (more than once). So, I sure don’t need this one, but it is not changing my plans anymore than trying to avoid the flu does each year. (Never any harm in stocking up and being ready for anything that may come, though.)

If the virus starts to break out near me, I’ll take a lot more precautions because I catch the flu just from looking at someone who sneezes. Yet, as a flu-prone person, I have very little fear right now about the virus because fear isn’t going to ad a single day to my life, but it may remove some; and I just don’t see the big threat in any of the numbers in any coming out of any nation.

While it has knocked the wind out of stock markets all over the world, it has been great for our family 401Ks. That’s the advantage of being prepared for likely troubles when you see them if there is something you can do and should do. So I have no hesitation in pointing out trouble when it’s coming, though I sometimes get accused of being a fear monger. I invested our 401Ks once again all in bonds and cash at the start of the year because I believe what I write, and those seemed like the safest refuge allowed in our 401Ks.

That means I’ll be in a great position to buy back into the market if it gets enough stupidity kicked out of it. That may take awhile. According to the NY Fed’s recession probability indicator, bond yields this low with an re-inverted yield curve almost assure recession, and I’ve said for over a year that it will be the forming recession that kills this particularly bull-headed market.

Bond yields have crashed through the floor to all-time record lows, but yields down equal prices up. Stocks, on the other hand, have already erased all gains for the year and then some. In just two days, the market completely erased one of the most amazing rocket-ride rallies of all time. Yet my bond funds are up 8% since the start of the year when I pulled out of stocks. Not bad for two months!

I sneezed on the virus and caught the Kung Flu

My face-the-truth and stick-to-the-facts approach has not, however, been good for my website. A number of patrons packed their pledges and left as soon as I wrote that the health effects of the virus do not appear much worse than the flu. Support fainted as soon as I published that. Since I write for truth and not popularity or money, I soldier on for the time being anyway.

I experienced a similar thing (but much greater) in loss of readership when Trump became president and my criticism turned from hitting the Obama administration to the Trump administration.

Obviously, I am not the fear-monger I am often accused of being. Others in the alt-press who are far more successful in terms of audience size and income than I am know they do best by always stoking fears. (People call it “doom porn.”) I’m only interested in being objective and accurate as much as I can all the time whether people like it or not.

I have some other sites that ask me to spice it up with darker images of what is coming, and I will certainly write such things if I see them coming, but I try not to be any darker than what we will actually wind up experiencing. That, however, is bad for profits. Choosing not to run with either the doom-porn pack or the fevered bulls leaves me without a crowd to please.

As David Korowicz wrote about supply chains in a paper for the Foundation for the Economics of Sustainability almost a decade ago:

As a species with strong attachments to group affirmation, being wrong in a consensus is often a safer option than being right.

FEASTA

(I’m not saying I’m always right, but I don’t ever follow the crowd, not even my own tiny crowd. I have to stay with doing what I think is right, whether it proves to be or not.)

I think the fear is somewhat understandable, even though I don’t see the numbers in the disease looking any worse than influenza’s death rate. Look at what we’ve seen all over the press: China has quarantined a mass of people equal in number to the entire population of the United States! That’s almost inconceivable, and I am sure the sheer scale of that is feeding fears that COVID-19 must be far more deadly than what China is letting on it, or why the huge response?

Maybe those fears will prove to be; but right now the death rate reported in all nations is turning out to be the same as in China. Some in the alt-press will say that is because all nations control their media, and all nations have conspired to tell the same lie. Maybe, but I’ll bet in the end, when the global economy has been ravaged, your own experience will not match your fears if you are one of those following that line of thought. You will find you don’t have a single friend who died of COVID-19. You may have some friends who get the disease if it gets completely out of containment or maybe even a lot, but you have many who get the flu each year, too.

There is a reason to fear fear itself. I could have jumped on the viral bandwagon (and still could in this article) and profit by selling fear just like almost all the rest of the press — alternative media and mainstream — in terms of the health concerns of the virus, but I have not. The economic concerns, however, are already playing out everywhere. So, on that, I’m reporting the facts.

Or, as Saxo Bank put it,

We do not want to advocate panic, but stress that a more rational approach does not underestimate the impact on economic growth and earnings as the story evolves.

Zero Hedge

Meanwhile, I write myself out of popularity by claiming things are coming that others don’t believe or by criticizing presidents that others do want to believe or by even just by not going with the alt-press conspiracy flow and consensus.

And why, I sometimes wonder. Why keep at it? I’m not going to change the leaders of the world or the consensus views of either the establishment or the disestablishment. As Korowicz continued in his essay,

Even if we can appreciate a warning, the inertia of the status quo generally ensures acting on such warnings is difficult. In general we chose the easiest path in the short-term, and the easiest path is the one we are familiar and adaptive with. We would rather put off a hard and high consequence decision now, even if it meant much higher consequences some time in the future.

FEASTA

I’ve argued here for years that the entire world was taking the easy way out of its economic ills by just snowplowing the problem straight ahead because no one wanted to bear the pain that the right medicine would require. Better to have an easy load now, people feel, and deal with a bigger problem ahead. In fact, buy the solution on credit, and let the next generation pay for it.

I also warned that I doubted we’d be able to push our pile of problems all the way to the next generation, and I do believe that’s what we’re starting too see play out now, but it may still take a long time to become evident to most because the Fed and government will step their current games up to the maximum amount of life support.

You know what bulls are full of

The real bull in this economy was everything that was said last year and this year about how the economy was as strong as an ox; earnings were great and justified the market’s climb; no recession in sight; etc.. Since most people equate the stock market with the economy, they believe the economy must be strong if the market is rising. Telling them their beliefs are wrong is not popular, especially not if they’re making big money from stocks for the time being.

Telling them that even the market is about to fall when it is soaring to record highs brings nothing but ridicule; but things can go from great to growling like a bear in mere days, as we are possibly seeing now.

Relating to the economic situation now at hand, Korowicz described almost a decade ago how economic collapse can easily come about when an economy is fragile:

… a small shock or an unpredictable event could set in train a chain of events that could push the globalised economy over a tipping point, and into a process of negative feedback and collapse.

Sounds like our times.

He also noted that …

Warnings may keep coming, and almost by definition, from the fringes.

Well I’m about as fringe as you get in terms of popularity or economic credentials (but not in terms of writing extremes). And this is how you stay on the fringe — by writing what others do not want to hear or not ticking their ears with conspiracies or the doom porn they do want to hear.

Far better to say: “Look, don’t blame me, nobody saw this coming, even the experts got it wrong.

And who could see a microscopic virus coming? So, the financial experts our world and our political leaders will almost to a person use the COVID-19 outbreak as the excuse for their failure … again … even though economic collapse, if it happens now, has been seen coming for a long time because the recovery plan is a bad plan. (That’s just one more thing I see coming, so mark my words.)

The alternative press its not the only arena fanning fears right now. The mainstream media, according to Trump, is feeding all the health fears and stoking the stock market’s certificate incinerator as everyone everywhere wrings their hands. The mainstream media likes headlines that sell by playing to fears and likes adrenaline almost as much as the alternative press. They’ve joined right in to show us all day, every day how bad things are everywhere.

Most of the media is making the story of our economic malaise about the virus. That will lead exactly to the outbreak of a big concern I do have about this virus, which is that it will provide the perfect scapegoat for both Donald Trump and Jerome Powell when their economic recovery efforts end in smoldering ashes.

Viruses like COVID-19 are known to kill weak organisms, and this economy was already on its death bed; so, it is exactly the kind of economy that a virus can kill. (Not saying with any certainty that the virus will do that, but it clearly has sent the flagging economy off to the hospital, and the Fed has no medicine that can cure our ailments, as even Mohamed El-Erian says in the video below:

Saxo Bank, quoted earlier, went on to say,

We expect price action to remain volatile as the toll of COVID-19 spread mounts and begins to materialise in hard data and company earnings over the coming months

Zero Hedge

So do I.

No wonder Minneapolis Fed Narayana Kocherlakota said that the Fed should not wait until its next meeting to make yet another rate cut, but make a double-sized cut of fifty basis points “Now!” More insurance policy. (That will be four rate cuts in barely over half a year — about as rapidly as the Fed cut going into the Great Recession — the worst recession in most people’s lifetimes — so keep telling me we are not battling off a recession already.)

Odd how we need so much medical support (ahem, “insurance”) from the Fed’s nearly expired cabinet of medicines at a time when the Fed and the president have just told us (quite resoundingly in fact), “The economy is strong!” (Of course, the Fed can cut rates down to the bone, but that isn’t going to restore supply chains or quell viral fears. Viruses are not responsive to interest-rate cuts in the stream of imaginary money.)

No wonder ex-Fed Chair Gramma Yellen said a week ago the Fed may have to start buying stocks directly. While low interest rates won’t save the economy, infinite money can buy stocks up to the moon even in a falling economy and save the market until the Fed owns every corporation in Amerika. Then no corporation will have to make money because the Fed can just print it for them ; ) Apparently a market infinitely rigged by central planners is better than a real one. It would take an act of congress, of course, to give the Fed that new power, but when the Fed asks, congress gives. At least, it does in the middle of any crisis politicians don’t know how to resolve.

Now, if anyone still thinks I’m a fear-monger or author of doom porn, you should see what banks are saying! Here’s Rabobank, the Dutch multinational banking and financial services company:

Regular readers will know that our four projected COVID-19 scenarios were “Bad, Worse, Ugly, and Unthinkable”. Current news today suggests risks that the base case is rapidly shifting from “Bad”, meaning only China is impacted, to “Ugly”

Zero Hedge

And what was their “ugly” scenario?

This ‘Ugly’ scenario would see the virus continue to rage in China, spread to ASEAN, Australia and New Zealand, and the cluster of cases in the US and Europe snowball at an exponential growth rate from their currently low base. In other words, developed economies would also be hit.

If the virus spreads in the West public panic would naturally be the immediate response. Just as seen in China today, people would stop going out and shopping to stay safe at home, or make panic purchases on fears of supply shortages and then stay at home. In short, the economy would largely grind to a halt.

Naturally, the services sector on which the West relies far more than China would be smashed: restaurants; pubs; bars; cinemas; concerts; conferences would all grind to a halt. International travel bans would be put in place. Supply chains would be broken. International trade would collapse along with domestic demand.

In this kind of scenario it is impossible to estimate the precise impact on the global economy – because there would be little global economy to speak of. Suffice to say, it would be a true depression … and a recovery based on medical breakthroughs rather than monetary-policy ones.

Now that’s what I call doom porn! And that’s from a bank!

While the economy and the US monetary system were already riddled with problems, which must not be overlooked lest we learn nothing at all from our ten-year recovery ride into depression, it looks like everything hangs on the choice of one little virus, which is apparently nothing to sneeze at.

Update (five minutes after publication): When I started writing this article, everything above about the market was accurate. The market sat where the top graph shows it sat. However, I cannot research and write fast enough to keep up with the daily dives in the market. Today, the US stock market plunged for what MarketWatch says is the largest one-day point drop in the 130-year-plus history of the Dow! Look at where the market got to by the time I finished writing the article:

We’re almost halfway to the bottom of the deep valley we hit at the end of December, 2018! And that was a level that took three months to hit with just half the distance to fall to get there! Moreover, a third of the entire three-year Trump Rally that started the day after he was elected has been wiped out in just one week!

Guggenheim’s veteran Scott Minerd called this day “possibly the worst thing I’ve ever seen in my career” and noted “the Fed is fairly impotent in this environment.” That’s from a guy who went through the dot-com bust with the market and through the Great Recession. Minerd added that the present situation by itself is likely to subtract 1.5% – 2% from US GDP growth. That would be in addition to the decline that was already in the works for this quarter, putting the US fully in recession by all remaining measures if Minerd turns out to be accurate.

This has, in fact, now become the fastest plunge of the Dow since the Great Depression. It is the first time ever that the S&P has plunged into a full correction from a market peak in six days.

All in a day’s fun that would not be possible if market’s delirious bulls, fattened by the Fed to the tune of half a trillion dollars over the last four months, had not stampeded market prices to the summit of insanity. This they did in a time when the ground underneath them is giving no foundational support! (Corporate revenue recession since last spring, corporate earnings recession for half a year (boosted only visually by buybacks), manufacturing recession for half a year, services recession just starting in the fourth quarter, and slouching GDP growth quarter after quarter, just to name a few of the big trends.)

Lesson to be learned about seeing obvious reality around you or go bulls?

Next Up: Numbers for the economy’s health have been running downhill for so long that we now have to tape more paper below the bottom right corner of the patient’s health chart to continue that line of decline. Those numbers will be my next report (unless more viral news breaks before I pull that together). After that, I’ll get on to my next Patron Post about the current and coming actions of the central banks.