The crude oil price rally has been completely crushed, though I’ll admit I was wrong when I predicted crude oil prices would plummet in March or April as the perfect storm developed against oil prices. Instead, they rallied. In spite of that, I continued to believe my error was in timing and not in fact — not in the fact that a another harsh fall in oil prices was beating a path to our doors.

The crude oil price rally has been completely crushed, though I’ll admit I was wrong when I predicted crude oil prices would plummet in March or April as the perfect storm developed against oil prices. Instead, they rallied. In spite of that, I continued to believe my error was in timing and not in fact — not in the fact that a another harsh fall in oil prices was beating a path to our doors.

Crude oil prices beaten down by a storm still building

So, I continued to write articles about the forces building against oil prices, even in the face of a strong rally — a rally that many believed would set a new floor for oil for the remainder of 2016. That storm has, as of today, completely clawed back the post-March rally by taking crude oil prices back to a three month low and to where they stood at the start of the year as well. West Texas Intermediate just struck $42/barrel today.

That said, oil still has not gone back into the dark valley from which it came in the winter of oil’s discontent, and to which I said it would return.

I still believe the full strength of this storm is yet to be felt. So, my oil price prediction is that we hit $30/barrel again, before next March, but probably even by this fall. I have to state a caveat to that prediction … and not because I want to hedge my bet. I don’t like hedging my bets, as I prefer to hit them straight on the nose for a clear victory.

As stated in an earlier article, we have no way of knowing anymore what the Fed with its cloaked operations, liberal hand, and infinite money potential is doing at any moment to manipulate the price of the oil market in the same way it has admitted to doing with the stock market. Anytime the Fed sees oil bringing a serious gale against its heavily encumbered member banks, you can now be sure it will intervene to save the banks (at any cost). The Fed is loathe to let markets be markets and has become so deeply involved in market manipulation that there is no longer any basis for assuming any market will run as a truly free market. (But, if my prediction is wrong, I don’t know how I’ll be able to show it was likely for that reason.)

Nevertheless, I think forces are moving in that will ultimately blow everything outside of the Fed’s control. When we arrive at that inexorable day when all the oil tanks of the world — and all the tankers on land and sea — are full (as I’ve said we are likely to do and as appears to be more the case all the time), it will be hard for the Fed to manipulate the price of oil with nowhere to store the oil it buys. Reality finds a way to leak in or seep out … eventually.

Crude oil price storm develops a new front as gasoline storage backs up

One of the big drivers in the current price fall is the rise in the number of full tanks on the demand side of refineries. Refined gasoline is starting to back up to serious overflow levels. As things back up on the outflow end of refineries, inflow of crude to the refineries has to be slowed down, so tanks start backing up more on the refineries’ supply end, too.

For almost two years, the spotlight in the global oil market has been on a surplus of crude. The latest stumble in prices has shown that the [now] glut extends further…. Combined inventories held by industrialized nations of all forms of oil — from crude to refined products to natural gas liquids — reached a record of more than 3 billion barrels last month…. In the U.S., gasoline stockpiles were at the highest for the time of year since 1984 as record consumption failed to drain the glut refiners created when crude was cheap…. “It is the plight of oil products — in particular the light products such as gasoline — that is slowing the pace of total stock-draws even as crude stocks fall, and of the eventual re-balancing….” [US] gasoline supplies are so swollen that at least five tankers hauling the fuel to New York were turned away over the past few weeks…. Even China, the world’s biggest energy consumer, has been dumping excess gasoline overseas to alleviate swelling stockpiles at home. (Bloomberg)

Yes, you read that right. Gasoline stockpiles — right now at the peak season of gasoline demand — are at a thirty-year high! If we cannot work down the oversupply of gasoline during the summer peak demand when everyone in the highly populated northern hemisphere is traveling, what will happen as demand drops off in the fall?

Gasoline inventories have increased four out of the last five weeks at the very time when they should normally be going down due to the normal rise in demand.

“We are gradually shifting from a crude glut to a refined product one, particularly in gasoline,” Thomas Finlon, director of Energy Analytics Group said by phone “The gasoline production numbers in the United States are just astounding.” (EconMatters)

Why are production numbers astounding for gasoline? Because with a glut that brings cheap crude oil prices refineries are boiling out as much gasoline as possible — more than they can sell — to take advantage of those prices. That is creating a major backup problem on the demand side of refinery storage where the final products are held for sale. (In essence, if your crude oil tanks are full, produce as fast as you can in order to move that oil into your tanks of product for sale … until those tanks are full, too.)

The red dragon has too much fuel for its fire

The over-abundance of gasoline in storage is certainly not limited to the US. The Great Red Dragon is choking to death on fuel. China is practically dumping gasoline and diesel all over global markets as a result of a supply overbuild already being at its limit throughout the Asian region.

The volume of China’s gasoline exports caught up with diesel last month as refiners dumped excess output in overseas markets to alleviate swelling stockpiles at home amid record domestic production. The world’s largest energy consumer more than doubled shipments in June compared with a year earlier…. The flood of shipments from China is exacerbating a glut of fuel across Asia, where processors are cutting operating rates as they grapple with a slump in refining margins…. (Bloomberg)

Dutch consultancy PJK International said that gasoline stocks held independently in the Amsterdam-Rotterdam-Antwerp (ARA) hub rose more than 12% to an all-time high. (Zero Hedge)

Earlier in the year, China ramped up refinery activity as much as possible in order to build gasoline and diesel inventory while the cost of crude was still in the basement. (Everyone wants to sop up as much cheap crude as they can.) Apparently, they have reached their limit on how much finished product they can store. So, both the supply side and the demand side of refinery storage in China is choked.

In late June, JP Morgan estimated that China had pretty well filled its strategic petroleum reserve tanks where it holds crude.

One of the pillars of oil’s recovery from the lowest price in 12 years may be on the verge of crumbling. (Bloomberg)

JPM estimates that, as soon as China has topped off their SPR to the brim, China will reduce its crude imports by 15%. (Recently, China has been the world’s largest petroleum importer.) No one knows what China’s maximum storage capacity is for either crude or gasoline, but JPM extrapolated last month that they are close to reaching their maximum based on what is known of their oil data. The rate at which they have suddenly started dumping gasoline on the market indicates their crude oil reserves are full and they are pushing oil through the refineries as quickly as possible and dumping into the market on the other side at minimal margins as everything finally backs up to capacity from the oil wells to the gas-station pumps.

Demand in China for crude oil fell by 2.7% in May; but Chinese imports of crude fell by a mind-blowing 41% year on year. That China is solving its backup by dumping refined products as exports is reflected in the fact that Chinese exports of refined petroleum products rose by 38% year-on-year in June, even as crude imports fell.

For the time being, pumping out gasoline as quickly as possible has kept China’s drop in imported crude to that 2.7%, but its creating a gasoline glut that is rapidly spreading across the globe. That is already choking China’s production and everyone else’s … all the way back to the pipes of the producers.

That all means we are much nearer that day when all the oil tanks in the world are full, which is extremely bearish for the prices of finished products and crude and should put more pressure on the margins of US refineries and oil producers alike. Certainly, China’s dumping of gasoline and diesel throughout Asia and Europe means that its imports of refined fuels from the US and other nations are terminated for those nations that customarily exported finished petroleum products to China. The market is now saturated everywhere.

Worsening inventories in oversupply of crude oil

The backup at the outflow end is new, but there is nothing new about the backup in tanks at the inflow end of refineries where crude sits waiting to be turned into gasoline and other products. Inventories on the supply side remain swollen. At 520-million barrels, crude oil supply is more than ten percent higher than where it was this time last year when it began its catastrophic price march downhill.

That combination of supply and demand-side inventory has reached an all-time record of 2.08 billion barrels. Now that refineries have limited places to put the surplus fuels they are producing, they are spinning their wheels in the slick oil sands. Refiners, and not just producers (not always one and the same), are now suffering collapsing margins.

At the same time, we’re nearing another maintenance season, when production is always cut, but that didn’t have much effect last spring as I (and some others) thought it would; but will it help form the perfect storm now that the entire oil industry is starting to choke in overflow?

A dangerous new trend line in crude oil prices

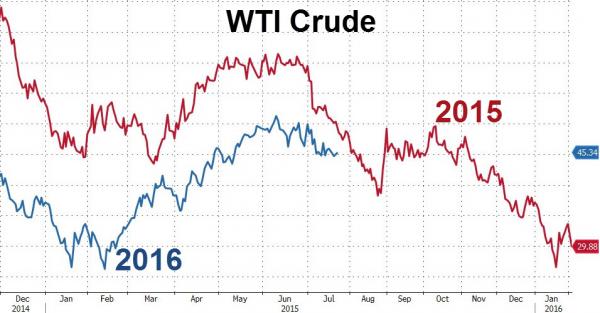

Zero Hedge published the following graph that shows how crude oil prices fell and rose and fell in 2016 and how that almost exactly matches the pattern of 2015, only at lower price points along the journey:

Demand for crude oil typically falls off during the second half of summer. This year crude prices peaked (for the present, at least) in June and have since slid about 17%. Last summer crude prices also peaked in June, and then July broke their back. The summer before that (2014), crude oil peaked for the year in June and then prices fell off a cliff the rest of the year, dropping 50% by year’s end.

Oil producers are concerned by what is shaping up to look like a new trend in the oil market where prices rally until June and then crashes the entire remainder of they year.

US rig count not staying down

Because this year’s earlier crude-oil price plunge crippled the US oil industry, the number of rigs drilling new wells began to drop, causing a drop in US crude-oil supplies (and, therefore, a rise in speculative oil prices); but as soon as prices started rising, rig count immediately began to climb back up. The US oil industry, in other words, is not willing to concede its loss of market share without further battles. Last week, the number of oil and gas rigs in the US jumped by fifteen, double the increase of the week before. So, the rate of rise is accelerating.

With a total US rig count of 462, that’s better than a 3% increase in just one month. Since May, oil and gas drilling rig count has risen by 56 rigs (a 14% increase). Still, rig count remains down by 414 rigs from where it was this time last year. At a total of 863 last year, the number was far below the all-time peak of 4,530 in 1981. This last March, the industry saw its all-time low in rig count.

The ramp-up of drilling is happening in oil fields that are profitable below $50/barrel. The moves are small by historic perspective, but, still, not in a direction that helps the price of oil if you’re a hurting oil company, hoping for salvation from a little price relief.

Damage to the US oil industry as a result of crude oil prices

To give you some idea of how significant damage from low crude oil prices has already been to the US oil industry, the world’s largest oil-field services company (Schlumberger Ltd.) laid off 16,000 workers so far this year as it surprised analysts lowest estimates in this quarter’s reporting with the size of its losses. Second-quarter losses were $2.16 billion, compared to a profit last year (also a lousy year) of $1.12 billion.

“In the second quarter market conditions worsened further in most parts of our global operations,” [Schlumberger CEO] Kibsgaard said in the statement. (NewsMax)

The world’s second-largest oil-field services provider has not faired well in 2016 either. Halliburton reported a 14-cents-per-share loss for the second quarter. Of course, both companies put as much positive spin on this as being “the bottom” as they could; but is that a real prediction or just CEOs trying to save their stocks from crashing harder with a positive spin?

If the oil surge is hitting the giants of industry this hard, imagine how this storm is pummeling the little guys.

Tightening the vice a little harder, Moody’s just announced that it will start to downgrade the credit ratings of oil producers who are too aggressive in expanding production capacity, given the market’s inability to absorb more capacity.

But it’s not just the oil industry that is feeling the pinch.

General Electric reported a drop in orders, led by oil and transportation decline. They are selling less of their heavy oil-field equipment. Less equipment is also being transported on trains at the same time that less oil is being transported inside the US (as the US cut back production while the Middle East seized market share as it aimed to do). That means fewer GE locomotives are being sold as well.

GE’s total orders feel by 16%, if one excludes the effects of global currency shifts and corporate acquisitions.

I don’t care a wit about greedy oil companies. In other words, I’m not playing a sad song on the fiddle while refineries and producers burn because I’m concerned they’re not making the fat profits they once made (and even taking losses in many cases now), but the fact is that their troubles are having a negative impact on the overall US economy. At the same time, we have not seen any great benefit in the terms of lower fuel prices (compared to the size of the oversupply), but that may change now that a gasoline glut is also building.

… and damage to US stocks

Naturally, oil industry stocks have declined along with oil prices over the past month, but the losses have an interesting reason for being. What has torn the top off the US stock-market rally in the past week has been oil producers hedging their bets in anticipation of a third crummy year for oil prices now that the end of 2016 is not looking as hopeful as the oil bulls thought it would. They’ve seized the day when stocks have been selling at better prices as an opportunity to sell stocks in order to raise cash and pay off debts, etc.

“The producers have sold the hell out of this rally,” said Stephen Schork, president of Schork Group Inc., a consulting firm in Villanova, Pennsylvania…. U.S. oil and gas producers have been selling shares at record speed, using the cash to repay debt or buy oil and gas prospects, bolstering the asset side of the balance sheet. So far this year, companies have raised more than $16 billion in equity, according to data compiled by Bloomberg. “They’re trying to generate cash to stay alive and fight another day,” said John Kilduff, partner at Again Capital LLC, a New York hedge fund focused on energy. “The producers know full well that the oil market is not out of the woods yet.” (Bloomberg)

Where will this storm the oil market carry us?

As I said at the start of the year ,when oil was in its steepest dive and people were speculating that Saudi Arabia and Russia would strike a deal to stop the crash, there was no chance of Saudi Arabia backing off. Saudi Arabia repeatedly made it clear to anyone who was listening that from this point forward the oil market would work itself out by who can produce the most oil the cheapest and claim the largest market share in a oily price and production war. Thus, I also announced the death of OPEC as a price driver a few months ago.

Saudi Arabia, which once controlled market prices by adjusting its own production, decided that the market will decide who the winners are because they are also in the best position to win a price war, having oil that comes at the lowest production costs.

Heavy industry is locking horns all over the world to fight for market share, and the battle is far from nearing resolution.

The narrative of a balanced oil market (in the second half of 2016) has so far been an illusion. (Reuters)