http://thegreatrecession.info/blog

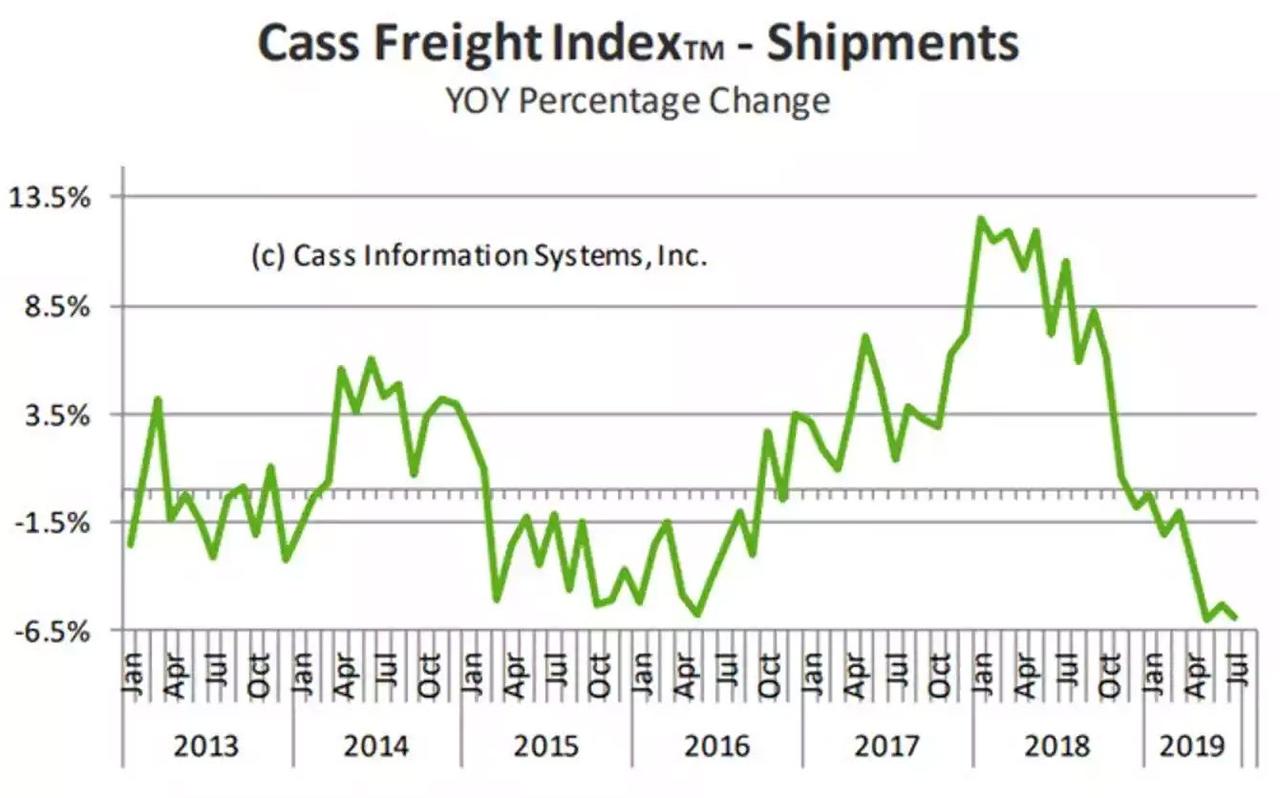

Pretty good if you ask me. Most economic indicators this year have moved relentlessly in the direction of recession, and now the Cass Freight Index is saying a US recession may start in the 3rd quarter, fitting up nicely to my prediction that we would be entering recession this summer.

Cass comes on board

The Cass Freight Index is one of the most robust proxies for the US and global economies there is. If freight isn’t moving, the economy is dying. As Cass says, their’s is a simple, fundamental approach to encapsulating the economy:

As we try to navigate the ebb and flow of the economy, we don’t pretend to have any ‘secret sauce’ or incredibly complex models that have exhaustively analyzed every data point available. Instead, we place our trust in the simple notion that the movement of tangible goods is the heartbeat of the economy, and that tracking the volume and velocity of those goods has proven to be one of the most reliable methods of predicting change because of the adequate amount of forewarning that exists.

Cass Freight Index Report

The Cass Freight Index has now been negative for eight months, marking 2019 as a year of recessionary decline. Cass Information Systems notes they have been highly reserved in stating the index reveals a recession is now because the index periodically goes negative without the US going into recession, but they also note the weakness has rarely gone as deep as this time or spanned so many modes of transportation.

We are concerned about the severe declines in international airfreight volumes (especially in Asia) and the ongoing swoon in railroad volumes, especially in auto and building materials.

Are not Carmageddon and a new housing crisis two areas I have been saying for the last 2-3 years would be helping take us into recession, along with the Retail Apocalypse (also hugely reflected in freight)? Have I not been saying all year the trade with Asia due to the Trump Trade War is going exacerbate the problem?

While it is rare for Cass to come right out and say they believe we may now already be in the first quarter of a recession; here they do:

Bottom line, more and more data are indicating that this is the beginning of an economic contraction. If a contraction occurs, then the Cass Shipments Index will have been one of the first early indicators once again.

As “economic contraction” is synonymous with “economic recession,” Cass is now fully on board with my view (not that they know my view). As they consider their index one of the first indicators to come in with a “recession is now” view, I consider myself one of the first to have placed recession starting as early as this summer as well — a prediction over which many people on other websites still stridently argue with me. They are welcome to their view, but I am holding unwaveringly to mine, even as summer is now half over.

Now I have Cass on my side of the table.

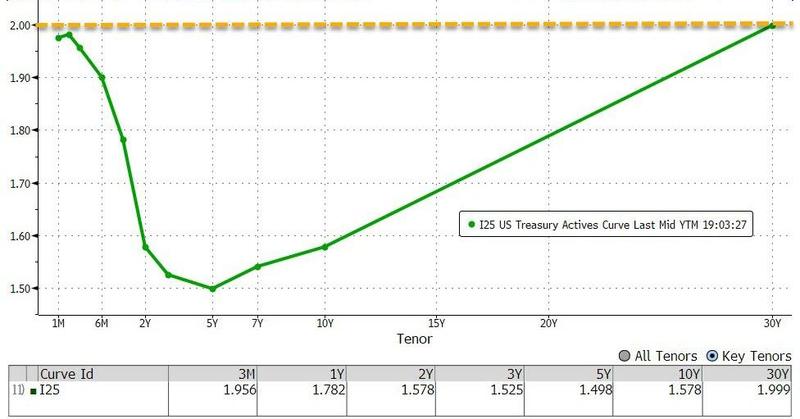

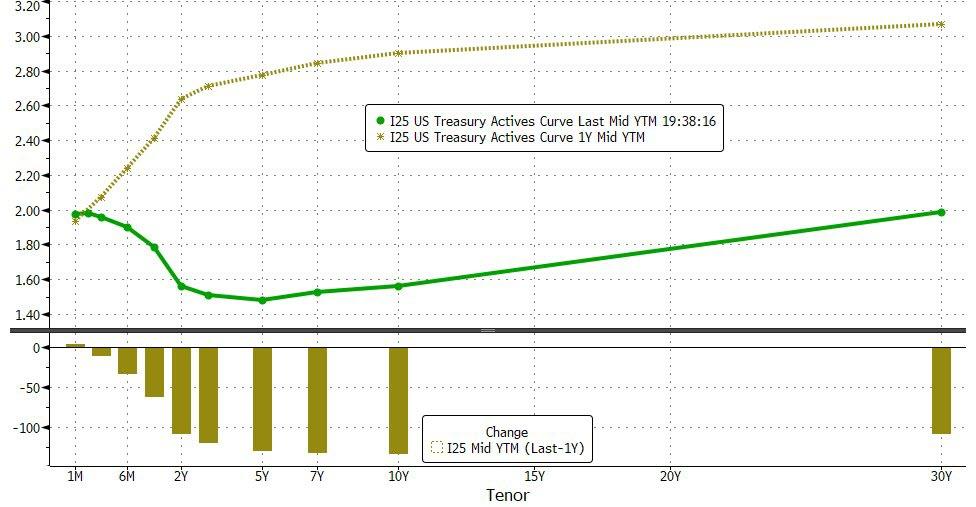

Yield curve inversion moves solidly to recession indicator

I’ve written a lot about how reliably the yield curve indicates a recession, so I won’t go into explaining here how that works. The curve typically inverts months ahead of a recession, and the curve first inverted last fall. For those hoping this time might be different, I’ll note that this time is exceptional in that the 30-year yield has now reached all-time lows and is lower than the 3-month yield and even lower than the Fed Funds Rate.

My, how the mighty have fallen! Only ten months ago, the 30-year was trading at 3.46%. Now it’s below the Fed’s bottom target interest rate, scraping along at 1.97%? What is exceptional, then, is how extreme the inversion is because the 3-month-over-30-year curve has inverted at the lowest interest rates ever. Ten months ago, the Fed was trying to raise interest rates. Since then rates fell off a cliff with the Fed doing nothing to lower them. It merely stopped trying to raise them. This is where the market has taken them on its own. Does that sound like the Fed is in control of anything?

One more thing that is different this time? For the first time ever, the entire US treasury yield curve is inverted!

As ZH noted, “What a difference a year makes”:

I’m just going to take a bold stab at this and say, I don’t think this exception is likely a positive! The exceptional low yield on 30s could indicate a lot of money is running a long way out to find safe haven for a long time to come. If the size of the inversion means anything, it will match up to the size of the recession that is coming with it. If you have swum in the ocean, you know how, when you feel a huge trough around you, you’re going to turn around and see a huge wave coming right behind it. This is that.

The extent of this mammoth yield-curve inversion and the low level at which it is happening also indicates the economy is so fundamentally weak it cannot function, except at extreme low interest all across the board!

According to Donald Trump, however, the economy is thriving, and you should be ignoring this sign. The graph above is where a year of Trumponomics gets you OR where the Fed’s attempt to unwind its recovery efforts gets you. Or, as I think, it is where the Fed gets you and where Trumponomics leaves you because the Trump Tax Cuts were unable to push up the trough the Fed created when it started its Great Recovery Rewind.

To our mutual relief, however, former Fed Chair Alan Greenspan told us about a week ago that these rapidly sinking and distorting interest rates should not concern us. It doesn’t matter if the US sinks into negative interest rates in order to keep the engines running. Zero, he pointed out, is just a number. I think zero may be the space-holder between his dumbo ears. I wonder if, when Jay Powell issued his rare gag order about a week ago to stop all Fed bank presidents from saying dumb things…, if he wished he could have applied that to Alan Greenspan, too.

“Appearances at conferences have been canceled, all scheduled interviews have been abandoned and any comments on or off the record are outlawed.” This unprecedented action is a reflection of two pressures. First, there are growing economic indicators that suggest the US is heading into a recession with the Dow plunging 800 points on Wednesday…. Second … Trump.

Spectator

Whoa! That doesn’t sound like crisis management, does it? Pretty strong order when your addressing Federal Reserve bank presidents, telling them they are not allowed to speak!

One critically watched component of the yield curve held out until just last week and then finally joined the inversion pattern, shocking the stock market into its worst recent drop of 800 points (fourth-worst in Dow history). It was this sudden matching up of the full yield curve in a consensus statement and the resulting shudder through the stock market that kicked Powell into crisis-management mode.

Apparently, it kicked the US president into crisis management, too. During the market’s free-fall, the president picked up the phone and made a conference call to several of the nation’s largest bankers. I don’t know what they talked about. Maybe Trump was extending an invitation for a cheeseburger barbecue while they were in town; but it happened at the same time Powell was telling Federal Reserve bank presidents to run silent, run deep.

That one component of the curve inverted again this Wednesday just as the market closed, confirming its union with the rest of the yield curve.

The spread between the yield on the 10-year Treasury note and that of the 2-year note on Wednesday turned negative for the second time in one week, a recession warning that flashed for the first time since 2005 on Aug. 14. The inverted bond-market spread is seen by many veteran traders as an important recession omen, though the timing on the eventual downturn is less predictable.

CNBC

This just leaves the question remaining about timing: did the clock start ticking toward recession when the main sweep of the yield curve inverted last fall, or does it start now that the 2s-over-10s portion of the curve finally joined and then confirmed? Most people time this indicator from when the curve first inverts. In which case, recession should be starting about … now.

Either way, this confirmation of the 2s-over-10s for the first time in twelve years puts this major indicator in unanimous consent now for recession, and that sent the stock market into convulsions, which is where you may recall I said the stock market would be as soon as the Fed’s first interest cut hit because there would be no good economic news left in the pipeline for stocks after that. I am sure Powell is not unaware of the connection between the stock market’s big plunge, the full yield-curve inversion and his first rate cut.

And it is certainly in good part, the Fed’s rate cut that triggered all these bond moves. Thus, we see the market now hangs every day on what the Fed says, obsessively watching for hints of what the Fed will do to create more stimulus to rerecover the economy that it crashed with its tightening regime.

The stock market, of course, doesn’t care what happens with the economy any more. It stopped doing that years ago. It only cares about getting more free money for speculating about more free money. Well, apparently it still cares a little because signs of recession all around it were a little more than it could take. It just want’s enough bad economy to keep the Fed’s meds coming, not enough to make it impossible to continue to support the fake narrative that business is fine.

The rapid change in the direction treasuries are pointing this month was a four-sigma event, which was described as being an impossible event. In this case that was explained as an event that normally occurs once, maybe twice, in a lifetime, but that just happened ten times in one month:

Indeed, the number of explosive moves that we’ve seen to start the month of August in “safe havens” is on par with what we saw during the worst months of the [great financial] crisis. We still have 2 weeks to go. What’s incredible is how little the broad investor universe seems to care.

Monday Morning Macro

It’s almost as if bonds are now sprinting to catch up with my position that the recession starts … “Oh geez, now!”

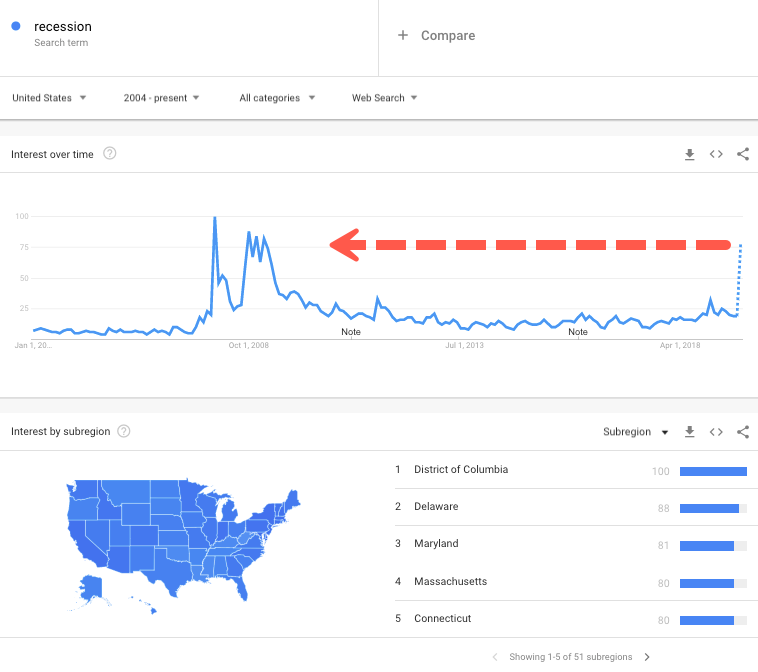

Recession is the new obsession

Recession is now the main narrative. One might say it has become the national obsession in this sense: Since the 2s-over-10s joined the rest of the yield curve, the word “recession” is now being googled more than any time since the Great Recession:

Note in the chart above that Google shows the most recent trend as a dotted line. The dots do not indicate that it is a projection. Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular.

Suddenly “recession” interest is nearing an all-time peak. Even economists are starting to catch on, and we know how slow they are about these things. Seventy-four percent of economists now believe we are declining toward a recession. They don’t put the date as soon as I do, but we all remember how economists were slow on the pickup last time around. Almost none of them saw the Great Recession coming, even when they were standing inside of it. That was one of the big reasons I started writing this blog. Still, a move to 74% is a large number coming online, at least, generally this year with the recessionary view. And it is all happening right in the summer when I said it would.

Multiple economists have said this month that the possibility of a recession is real and growing. Recession concerns have intensified since the beginning of August.

CNN

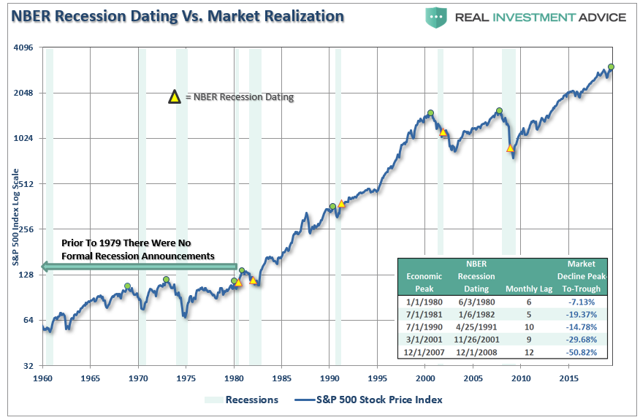

Don’t worry. They’ll catch up with me … after the recession is over. At least, they are now cuing up to talk about recession. As Lance Roberts wrote about the ability of economists to see a recession coming,

Just as in December 2007, there was “no recession.” It wasn’t until December 2008 that the data was revised, and the National Bureau of Economic Research (NBER) announced the recession had begun a full year earlier in December 2007.

Seeking Alpha

Might this be why Trump, while he claimed in self-defense this week that most economists don’t now see a recession coming, was immediately thereafter mulling over the idea of a temporary payroll tax cut? Sounds like an emergency measure to me.

Several senior White House officials have begun discussing whether to push for a temporary payroll tax cut as a way to arrest an economic slowdown, three people familiar with the discussions said, revealing the growing concerns by President Donald Trump’s top economic aides.

The Hour

Oops.

While the sources there were anonymous, as is is the media standard these days, Trump let the cat out of the bag, himself, by saying he was considering a payroll tax cut but not any more.

Oops.

Payroll tax cuts have typically only been granted during economic downturns as a form of instant tax stimulus. Such a cut that benefits the middle class would certainly have been more effective at stimulating the economy, instead of just the stock market, than the corporate tax cut we got; but it would still add just as badly to the national debt.

One might ask, if the corporate tax cuts were effective as was promised and if they sent us much deeper into debt, as we now know, why are more tax cuts even being considered? Might Trump’s consideration of more cuts mean the previous cuts failed to deliver on their promise? Or that things are looking more dire than the president let on?

To prove he’s not concerned about the current economic downturn, Trump has unleashed White House Lunatic Larry Kudlow and Peter Navarro and Kelly Ann Conway to spin up as much cotton candy in the public narrative as possible. They seem to have been working overtime in the past week to convince the nation that all is well. Methinks they doth protest too much.

What I find funny is how, each time Laughable Larry and the other guy tell us the economy is doing exactly as their tax plan said it would do, they end by begging the Fed for more free recovery stimulus money at the end of the interview, even though the Fed is already at historically stimulative interest rates. I think Larry is starting to sound a little desperate.

Doesn’t Larry sound just a wee bit drunk when he says, “What’s wrong with just a little bit of optimism?” The last time Larry didn’t see a recession coming at all was at the end of the George Bush years. Now that we know your code, Larry, thanks for the warning. And this is “about as good as it gets” he tell us.

I’ve pointed this out before, but here is Larry finally admitting he made that mistake and then trying to cover for it at the same time:

Back then he was championing Trickledown 2.0 and trying to convince the nation it was working when it wasn’t. Now, he’s trying to tell us Trickledown 3.0 is working “about as good as it gets.”

Ah, yeah, nobody saw it coming, Larry. Well, except for those of us who did back in the same month when Larry wrote there was no recession anywhere in sight, which he wrote because some people were beginning to ask if a recession was coming when, in fact, one was already there! (As Lance Roberts noted above.)

On that note, notice how talk of recession now has suddenly shifted into the present tense:

“I don’t think we’re having a recession,” Trump told reporters. “We’re doing tremendously well. Our consumers are rich. I gave a tremendous tax cut and they’re loaded up with money.”

CNBC

Then, this Tuesday, the inconceivable happened…

…Trump gave up the long pretense that the economy is not sliding into recession, and said it could be sliding into recession and it could be due to his China trade war, but it will be short:

President Trump has spent days arguing that recession fears are a media construct meant to take him down. His aides have told us that the “fundamentals of our economy are very strong” and that there is no recession on the way. They even falsely denied that he’s looking at quick fixes (such as a payroll tax cut) to ward off economic pain.

But Tuesday, Trump sang a much different tune. Rather than play off the idea of a downturn, Trump leaned into it — and even suggested that a short-term recession might simply be the cost of waging his much-needed trade war with China….

A couple of points: First, the entire monologue undercuts Trump’s regular assurances that the trade war isn’t hurting the economy. He has frequently said (wrongly) that China pays for the tariffs, and his administration has argued that the impacts are negligible — whether on consumer prices, on the stock market or with a potential downturn.

The fact that Trump is now entertaining the possibility of a downturn shows he knows he can deny, deny, deny for only so long….

He has decided (correctly) that he’s going to have to own any kind of a downturn or recession that might happen, so he has set about making the argument that it would be temporary pain in the service of a long-term gain.

MSN

So, even the president, long a recession denier, is admitting, “Yeah, OK, this could be taking us into a recession, but it won’t last long.” Why is talk, even at the presidential level, moving in this recessionary direction all of a sudden? Because the recession is developing right now and can no longer be denied; so, political talk has to switch to managing that crisis. This was the first presidential step into controlling the narrative that is now everywhere — not by denying it but by saying it will be short and is happening for the right reasons.

Little does Trump know (unless the conspiracists are right) that Trump is needlessly taking the blame right into his own lap by pinning the recession fully on his trade war when it is really the Fed to blamer which was foreseeable all along, not inconceivable. By design of default, as I said before the election, he will become the Trump Chump for the Fed’s failure. (More on that at another time.)

Consumer sentiment finally joins my parade

One usually thinks of parades as a “procession,” but this is a recessionary parade. Consumer sentiment had been holding out on me, refusing to join the march of statistics moving in the direction of my summer recession prediction. CNBC noted this month that consumer sentiment remained strong as a bulwark against recession and that retail sales were up accordingly!

Yay! Well, until it wasn’t.

Sentiment is a lagging indicator. Consumer’s feelings don’t change until they feel problems building around them. Those feelings can turn quickly when employment turns and hits home. As noted many times, recessions typically begin 1-3 months after unemployment starts to rise. Sentiment has just made such a quick turn, so let us not forget that this is a consumer-driven economy; things speed up going downhill when sentiment turns south and starts pushing them. It’s a lagging indicator, but a big accelerant once it recognizes the fall has begun.

The Fed’s rate cut did what I’ve said it would do and triggered concerns about recession (both in the bond market and the consumer market). As a result, the University of Michigan’s Consumer Sentiment Index fell hard in August, dropping from 98.4 to 92.1, which was worse than any economist expected in Bloomberg’s earlier survey. Consumer opinions about current conditions and expectations regarding future conditions both fell to their lowest point since Trump was elected:

They’re losing faith. Consumer sentiment overall fell 6.4% month-on-month and 4.3% year-on-year. 33% of consumer’s polled also noted without prompting that the imposition of additional Chinese tariffs had them concerned. Consumers concluded, based on the Fed’s action, they will likely be more careful from this point on about spending.

UMich commented,

Consumer sentiment declined in early August to its lowest level since the start of the year. The early August losses spanned all Index components. Although the Expectations Index recorded more than twice the decline in August as the Current Conditions Index …, the Current Conditions Index fell to its lowest level since late 2016…. Perhaps the most important remaining pillar of strength for consumer spending is favorable job and income prospects, although the August survey indicated some concerns about the future pace of income and job gains.

University of Michigan

If and when employment completes the turn it appears to have started, consumer sentiment will sink like rock.

Employment now marching with me

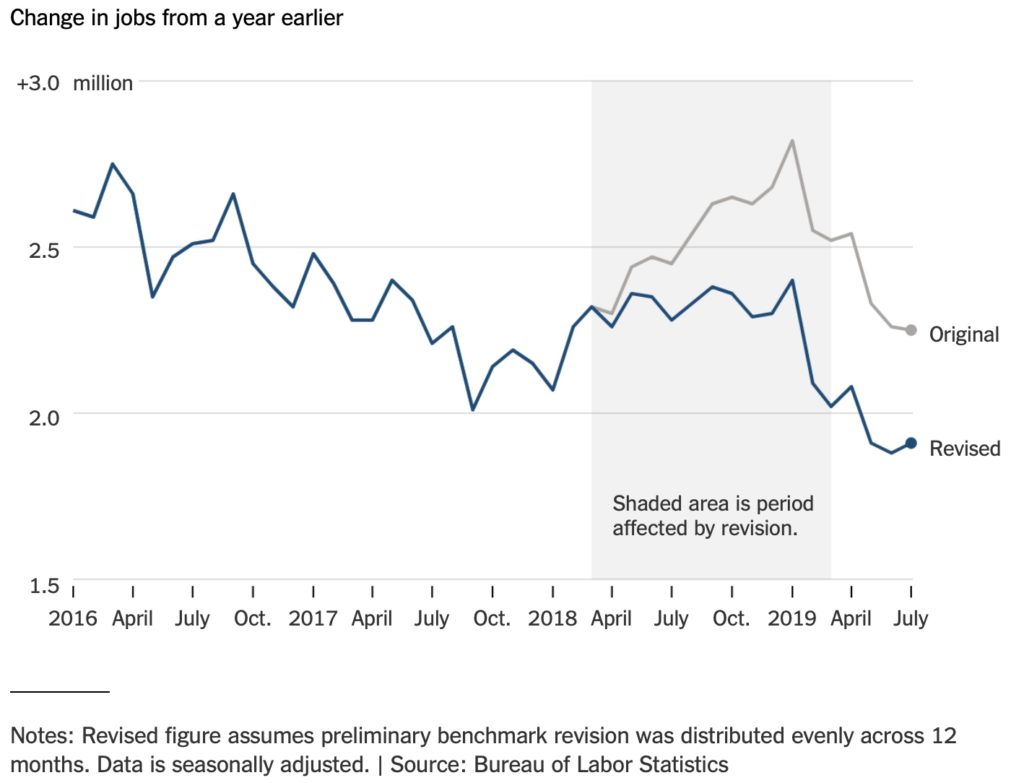

About this oft’-spoke idea that employment is remaining strong: The BLS just published a revision to its count for jobs in the economy and dropped the count by half a million jobs. It’s not abnormal for them to revise their count down, but the size of the revisions was substantially more than usual — the largest downward revision for a year’s worth of data (March 2018-March 2019) since 2009:

What this means is that the average 223,000 per month gain in new jobs reported during that period was actually about 180,000 new jobs per month, which is just above the recessionary 150,000 that breaks even with growth in the labor pool, which takes us down to the lowest job growth rate we’ve seen in years:

So much for trickle-down economics trickling down. The big losers were retailers and restaurants, where I’ve been saying for two years we were going to start seeing a lot of job losses and economic damage due to the Retail Apocalypse. Once again we find the government statistics getting revised downward a year later.

Business bankruptcies have been rising this year, and that is starting to drive up job losses:

“Bankruptcy-related job losses are grimly reminiscent of the Great Recession.”

In the first seven months of the year, U.S.-based companies announced 42,937 job cuts due to bankruptcy, up 40% on the same period last year and nearly 20% higher than all bankruptcy-related job losses last year, a report released this month concluded. Despite record-low unemployment, bankruptcy filings have not claimed this many jobs since the Great Recession…. “It is the highest seven-month total since 2009 when 50,258 cuts due to bankruptcy were announced…. In fact, it is higher than the annual totals for bankruptcy cuts every year since 2009.”

MarketWatch

(Ever notice how everything keeps point back, to being as bad as the Great Recession?)

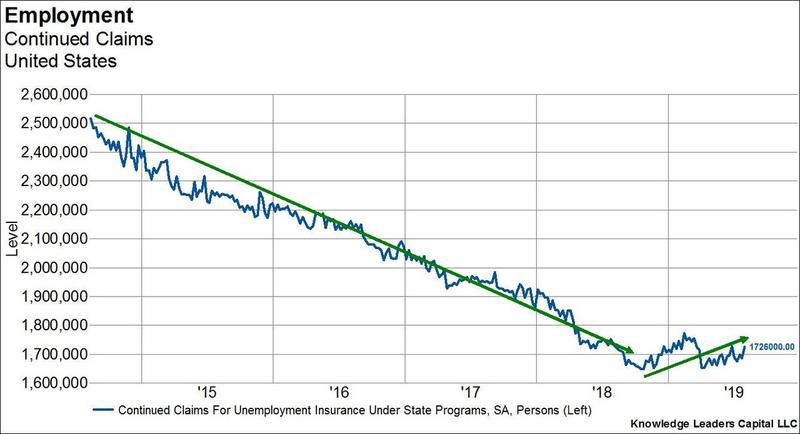

So, it should be no surprise that “continuing jobless claims” turned the corner this year and are starting to rise:

The long downward trend in continued unemployment has clearly found its bottom. Continued unemployment is starting to rise. Note that this is usually considered a lagging economic indicator — a sign of where we already are.

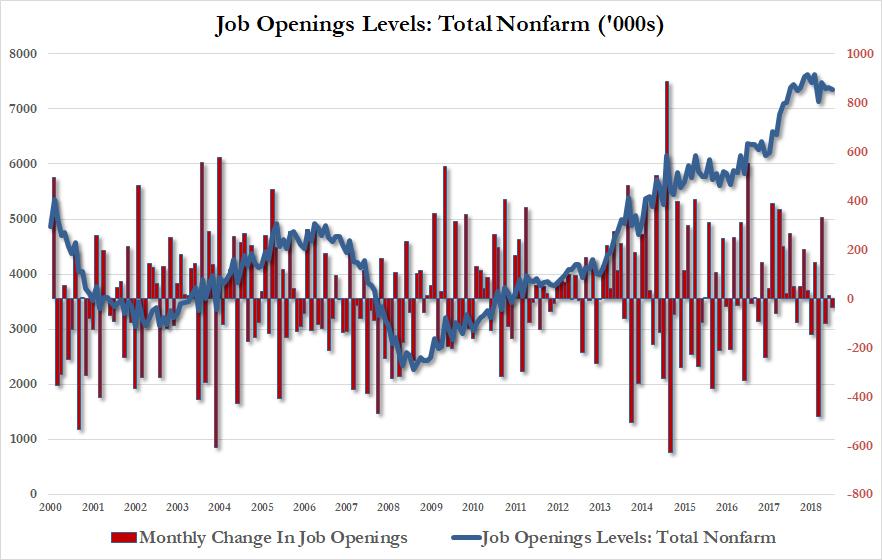

Job openings in the US just hit a four-month low, and hiring has dropped to its slowest since Trump became president. As you can see job openings have formed an evident top:

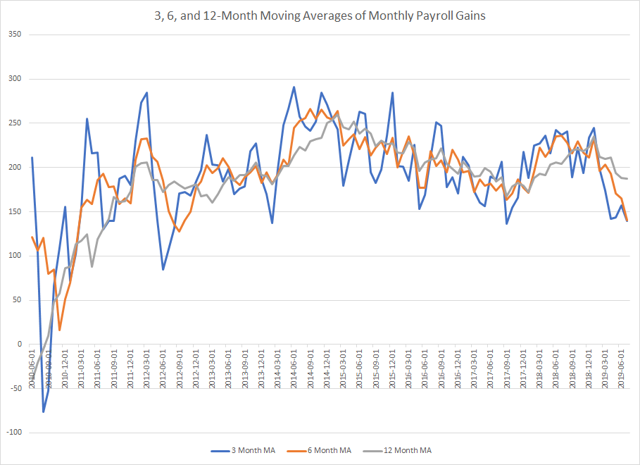

Three-month, six-month, and one-year moving averages for payroll gains are all down sharply to their worst levels … since the end of the Great Recession: (Using the averages all of the noise and seasonality.)

I’d say that pretty much sounds like the job market is resting on its skids, and the economy notoriously enters recession almost as soon as unemployment turns back in the wrong direction, and overall unemployment, too, looks like it may be forming a bottom:

Whose default is it?

According to Bloomberg, bond defaults — especially in the energy sector — are soaring back to those 2016 highs we experienced during a period of collapsed oil prices. At the present rate with four months left to go, defaults should surpass 2016:

Defaults on bonds issued by debt-laden U.S. companies with speculative-grade ratings are on pace to reach a new high this year for the post 2008 crisis era, according to Goldman Sachs analysts.

MarketWatch

The defaults are noted as particularly rising in the energy sector, which, of course, is where we saw defaults rise in 2016 as part of a big stock-market plunge that January that ended in closed-door emergency meetings of the Fed and of the Fed Head with the president.

“Our main source of worry is the fact that the improvement in U.S. fundamentals since 2017 can be entirely attributed to the energy sector,” wrote Michiel Tukker, Oxford Economics’ global strategist in a note Friday. “It is telling that oil hasn’t risen despite OPEC cuts and tensions in the Gulf of Hormuz,” Tukker added.

Of course, corporate bond defaults will grow worse if other industrial sectors, such as manufacturing, join in.

I don’t have to manufacture a recession; manufacturing is doing it for me

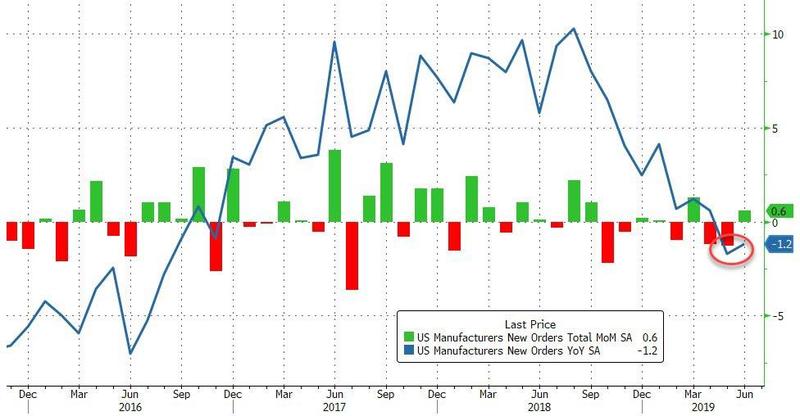

Manufacturing has been in contraction for the past few months now, with new orders hitting a ten-month low.

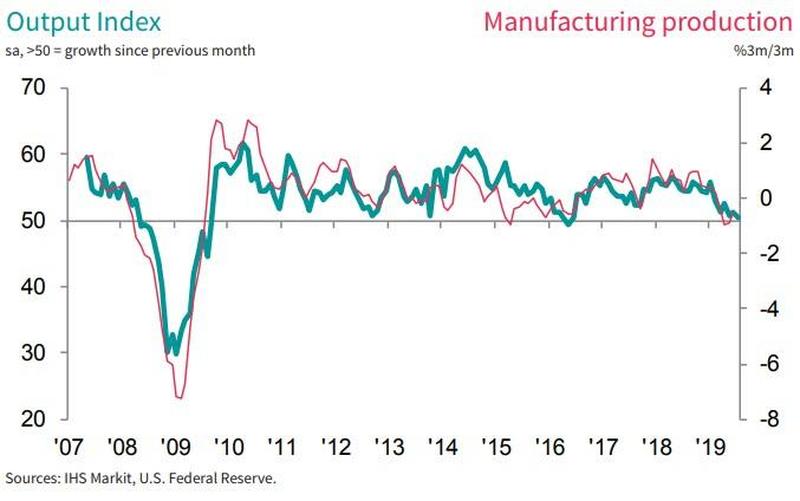

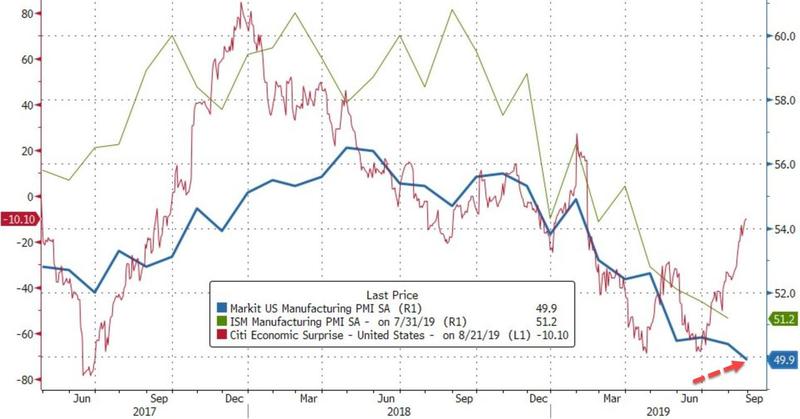

And the PMI hit its lowest since September 2009 in the middle of the Great Recession. This drove down manufacturing employment for the first time since June 2013.

“US manufacturing has entered into its sharpest downturn since 2009, suggesting the goods-producing sector is on course to act as a significant drag on the economy in the third quarter. The deterioration in the survey’s output index is indicative of manufacturing production declining at an annualised rate in excess of 3%.… US manufacturers’ expectations of output in the year ahead has sunk to its lowest since comparable data were first available in 2012, with worries focused on the detrimental impact of escalating trade wars, fears of slower economic growth and rising geopolitical worries. Employment is now also falling for only the second time in almost ten years as factories pull back on hiring amid the growing uncertainty.

IHS Markit

That’s the broad sweep of where we are. Here is an up-to-the-day closeup just in: (Any reading below 50 represents economic contraction.)

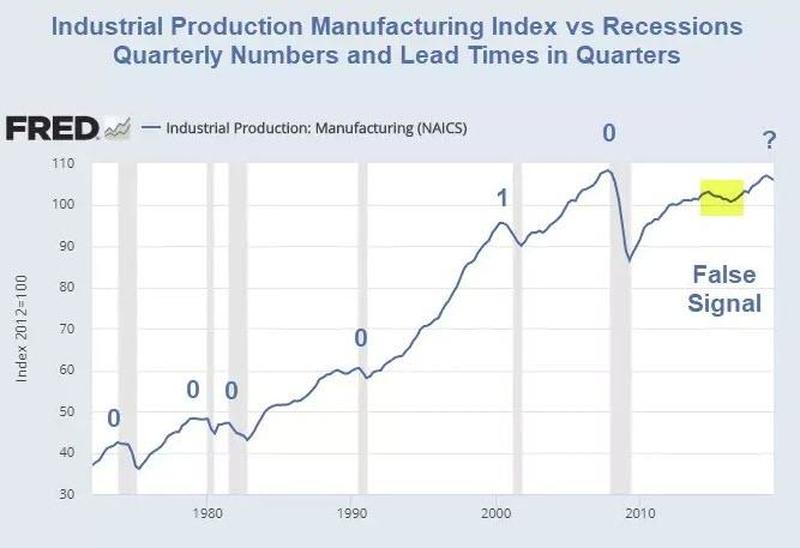

How much does it matter if we go into a manufacturing recession, as we are now doing, and how much lead time is there between a manufacturing recession and an overall recession?

It would appear it matters every time but one, and the lead-time is typically zero quarters!

One indicator that stopped moving my way

Housing is the only indicator I’ve seen that started moving in the opposite path of my recession prediction. While annual housing sales, as tracked on a month-to-month basis, fell throughout 2018, particularly plummeting in the last half of the year, as I said last summer housing would do, the Fed’s massive policy reversal this year has finally reduced mortgage rates by enough that housing sales have been improving this year, though it still remains (in terms of annual sales) below its peak:

To show that another way,

We got a blip. We finally got an uptick in year-on-year sales of existing homes, after sixteen months of year-on-year declines.

Of course, my predictions of where the economy is going on this website through the years have been in large part about where the Fed’s recovery actions would take us, how their recovery would fail, when it would fail and how they would reverse course; so, it is no surprise that course reversal would eventually help houses out again and that it can change the direction the stock market moves, too, as it did after the crash last fall. But the question is how much and for how long now that the economy is moving into recession?

My constant statements that the Fed’s policy changes will be too little too late to save the economy from going back into the belly of the Great Recession still stand. That move to recession will take housing back down again, even if interest rates go lower, just as happened in the first couple of years of the Great Recession. The Fed kept lowering interest, and housing kept falling until well after the recession bottomed out. I’ve also said the Fed will attempt a lot more economic bailout, but success will be faltering, and then back down we go again.

Retail also got an upbeat note recently, but that was largely driven by Amazon Prime Day and is not, therefore, reflective of an overall change in the decline in retail. As noted, the current sudden reversal in consumer sentiment is going to start weighing more on retail as consumers specifically stated they will be watching their spending more closely from this point forward due to the Fed’s reversal on interest rates and concerns about trade tariffs.

Elsewhere around the world

The UK economy receded in the second quarter for the first time since 2012. One more quarter of that puts them in recession, and Germany’s economy took a big slide toward recession.

All of these are signs that the risk of a global recession is a clear and present danger…. Call it a major hangover as the reversal in tariffs was not coming from a position of strength, it was coming as a result of global economic reality sinking in, a reality that is making its way rapidly to US shores as well…. Every single recession in the past 45 years has seen a 2 year/10year yield curve inversion preceding it. To believe no recession is coming is to argue that this inversion is defying history…. The massive tax cuts of 2017 have produced little in the form of growth other than a temporary sugar high. Growth is slowing and has been slowing. Long gone are the promises of 4% GDP growth. Rather growth is looking to drop below 2% in lieu of a trade deal. The only thing that has been growing are deficits on pace to hit $1 trillion this year already….. The system will aim to defend itself and it will do so with further rate cuts, currency interventions, and perhaps with a surprise end to the trade war. But reality is dawning and the bond market has been signaling this reality all year.

Northman Trader

In conclusion

There is too much evidence for me to present in support of a recession either sitting right on top of right now or being imminently close. The evidence I’ve gathered for this article is probably already going beyond anyone’s reasonable attention span, so I will just lay out the rest in headline links. Almost everything in the news now fits my statement a few months ago that there would be no good news left in the pipeline for the stock market after the Fed’s first rate cut.

Since there is so much bad news clogging the pipe in August after the Fed’s rate cut, I’ll skip the hundreds of articles that say essentially the same thing in different publications and just list those from a variety of publications that build the evidence of recession:

“3 Charts Confirming The Global Economy Is Already In Recession“

“Markets In Turmoil: ‘Clubbed Like A Baby Seal!‘”

“The Stock Market Bear That Began 19 Months Ago“

“Bank stocks take a beating as inverted yield curve fuels recession fears“

“Bankruptcy filings rising across the country and it could get worse“

“Bank of America raises chance of a recession to 1-in-3 in the next 12 months“

“Worse Than 2001 And 2008: One Bank’s Recession Odds Just Hit An All Time High“

“Wall Street Bonuses to Take a Hit From This Year’s Trading Slump“

“Payroll Friday: This Is Bad, Folks“

“Brace for a 2nd wave in stock-market volatility — and this one could be ‘Lehman-like,’ says Nomura“

“ISM Services Weakest Since 2016, Business Expectations Hit Record Low“

“Global Stocks Crash, VIX Surges, Europe Tumbles As Currency War Begins“

“Dip in Seattle home prices leads nationwide slowdown“

“That Was One Of The Most Manic 36 Hours Of Trading In My 18 Year Career“

“Lowe’s Lays Off Thousands of Store Workers“

“Sea Of Red: Global Markets Tumble In Post Trump Tariff Carnage

“What Booming Profits? Pretax Corporate Profits Still At 2011 Level“

“Bizarre Times. All Bets Are Off“

“Trucker Bust Begins As Oversupply Plagues Freight Industry, Spot Rates Crash“

“Chicago PMI 2019 Collapse Is The Worst In Over 30 Years“

“US-China Trade Talks Collapse After Half A Day Of Negotiations“

“It’s Already An Earnings Recession And The Second Half Is Looking Even Worse“

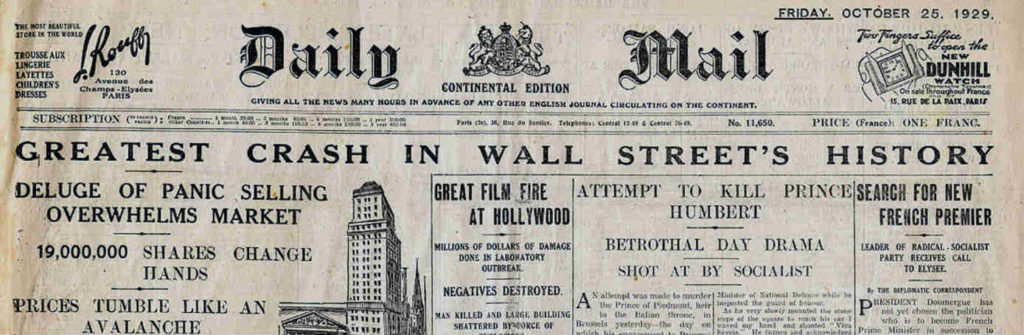

With that constant drone of headlines streaming in, it may not be long until you’ll see something like this on the front pages:

Whether I prove right about recession starting in the US this summer once GDP stats come in months from now and then get their normal downward revisions months after that, one thing is certain: recession definitely became the headline news this summer and a sudden big concern for the Fed and for the president and for consumers who follow the Fed.

I don’t know how it sounds to you, but to me this parade of data reports and headlines that I expected would show up like this right after the Fed’s first rate cut this summer, sounds an awful lot like recession could already be here. If not, it is certainly close by and breathing down our necks.

That is why the Fed is cutting rates and saying there is no recession in site (lest it assure there is one by saying there is — a self-fulfilling prophecy if the Fed says it). That’s why the president is putting all of his mouthpieces on the street and in the airwaves to proclaim there is no recession while saying, himself, he doesn’t believe we are currently in a recession, and then changing to, “OK, well maybe, but….” That is why the bond market, deemed “most reliable indicator” by the Fed, is sprinting as if to catch up with where we are, and why the Cass Freight Index has been screaming so long that Cass finally made the call and said, “Economic contraction (recession) is probably here now.”

Suddenly, summer came, and recession is in the air everywhere. It’s become the talk of the town. If it turns out further down the road that I missed my summer timing, I sure did get close because no one can stop talking about it now right when I said it would become the theme of the year.

Why was this so predictable? The Fed’s Great Recovery Rewind, spoken of often here.

This is what rewind looks like after an unsustainable recovery that has always been kept alive solely by the Fed’s artificial life-support, just as I was writing in the first days of this blog would prove to be the case once we finally got to the Fed’s full removal of life support. Pull the plug, and the patient is dead because he died in 2009. This is what recession smells like on its way in and what a dead patient smells like on his way out.

This is why I’ve been writing all these years, so that when we finally got to this point, no one could say, “No one could have seen this coming.” They can say it, but this site stands as a testament to the fact that the present economic collapse upon the recovery effort’s termination was always foreseeable.

It has always been easy to see this coming if you have any understanding of economic fundamentals, which the entire world has strayed far from, and we will never have lasting recovery unless we bite the bullet, pay the cost. leave Wonderland and return to solid economics.

Making that message stick is why I hope you’ll keep me writing, and why I thank those who already have. The time to make sure we don’t misunderstand what is happening all around us and why it is happening is now. If the lesson is missed, we’ll do it all over again.