http://thegreatrecession.info/blog/epocalypse-now-for-global-economy/

First I said I believed the US stock market would plunge in January, but I also said that January would not be the biggest drop, but just the first plunge that begins a global economic collapse: the big trouble for the economy and the stock market, I said, would show up in “early summer.” That’s when the stock market crash that began in January would take its second big leg down, and global economic cracks would become big enough that few could deny them.

First I said I believed the US stock market would plunge in January, but I also said that January would not be the biggest drop, but just the first plunge that begins a global economic collapse: the big trouble for the economy and the stock market, I said, would show up in “early summer.” That’s when the stock market crash that began in January would take its second big leg down, and global economic cracks would become big enough that few could deny them.

(Now I’ll add a prediction — that even worse will unfold in the fall and early winter … unless summer becomes so bad that central banks rapidly reverse course on unwinding their balance sheets and raising interest; but I think they will stay their promised courses into the fall and winter and headlong into a global economic crisis.)

The stock market did plunge in January and on into February, with the Dow eventually taking its largest single-day point drop in its long history. That drop busted the Trump Rally, and the market never recovered, leaving US stocks (and stocks all over the world) shattered in “correction territory” for half a year. With a half a year for perspective now, here is a look back what that event did:

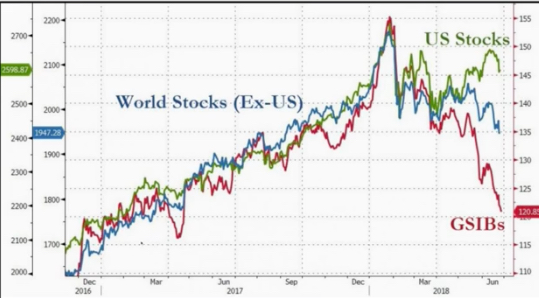

Global Stocks (except US), US stocks, and too-big-to-fail bank stocks. Where did the market trend abruptly change for all?

I’ve waited patiently through the first half of the year to talk in depth about how my January prediction faired because I felt we need many months in order to discern whether a trend has really been broken. You can see now how the steep rise in stocks at the end of 2017 turned out to be nothing but irrational exuberance that led to disaster (that, too, as I said it would prove to be at the time), which fell away as quickly as it built because it was void of substance.

You can also see that the problems that global stock markets are now experiencing did not start with the recent imposition of trade tariffs either (as the media is largely saying because they have no concept of the underlying fundamentals), though a trade war was practically assured to play a major compounding role, given President Trump’s two years of threatening a trade war (first as candidate Trump then as President Trump).

No, the event that triggered the demise of all of the world’s stock markets was exactly the one I laid out early last year. You can plainly see that the drop in all markets began the day the Federal Reserve increased its initially lax quantitative tightening program by 100%, which was at the end of January. You may also recall my writing last year that I did not think the Fed’s quantitative tightening, which was set to begin in the fall, would be enough to create much shock in the fall; but that, when the January increase came, we’d feel some real bounces in the road.

Take another look at the graph above, and you’ll also see where an even steeper break downward begins for major bank stocks — right at the end of April when the Fed implemented its next promised increase in the rate at which it is unwinding its balance sheet.

What is really happening is that, as the Fed is letting the air out of all the tires, all the stock markets in the world — since the dollar is a global currency — are becoming less stable. They are becoming less stable because it was always only central bank free-and-easy money that supported an artificial wealth effect in stocks and bonds. Therefore, as more air goes out of the fake recovery, all markets are less able to withstand the shocks in the road that hit them. The fail-safe shock absorber that “the Fed has your back” is gone.

It has been my central thesis since beginning this blog that the Fed’s recovery was a mirage that would end as soon as central-bank artificial life support is finally removed. Each time they have pulled back, we have had problems — not always as bad as I predicted along the way, but always severe and always exactly on schedule with their pullbacks. Now the Fed’s life support is being completely removed, but we do still derive some benefit from the artificial support of most of the world’s other central banks.

There was absolutely no chance that the Fed’s recovery, which did nothing to correct the serious debt-based flaws in our economy (but only exacerbated them), would prove sustainable. The idea that that you can build enduring national wealth out of the fake wealth effect from mountains of debt is laughable fantasy.

That’s why I confidently predicted last year the second big leg down for the US stock market would happen in the early summer of 2018 because the Fed will once again (in late July just before the middle of summer) increase its deflation of money supply, which has already become fairly strong. July’s 25% increase in QT is 25% of a much larger number, and that bump will hit when the world is already weak and wobbly from the previous increases. That’s when things get interesting, especially under the uncertainties that come along with a president known to be tempestuous, unpredictable and even erratic.

Markets (when they are not being smoothed along by the artificial life support of central banks) do not like uncertainty. So, things will get even more interesting in the fall when the Fed finally accelerates its rattle-trap unwind to full velocity, just as the US election cycle enters full combat mode. From that point on, it’s full unwind all the way at the Fed until they figure out that they’ve created the next economic collapse.

Finally, everything will fly off the road completely at the end of the year IF the European Central Bank still has the courage (highly doubtful by then unless the developing crisis is intentional) to start its own unwind as promised. The road ahead gets rockier and rockier, and the weather is dark and stormy; and our car is just about riding on its rims already and just about out of gas.

The Trump Tax Cuts, which were far from being a reality back when I made these predictions, will help the US, of course (and especially help the rich bail out); but they won’t help the rest of the world. You can already see those tax cuts haven’t even been enough for US stocks to overcome the Fed’s deflation of money supply so far (even with the record stock buybacks created from those tax breaks).

Zero Hedge summarized the first half of the year as follows:

- Bitcoin Worst Start To A Year Ever

- German Banks At Lowest Since 1988

- Onshore Yuan Worst Quarter Since 1994

- Argentine Peso Worst Start To A Year Since 2002

- US Financial Conditions Tightened The Most To Start A Year Since 2002

- Global Systemically Important Banks Worst Start To A Year Since 2008

- Global Stocks Worst Start To A Year Since 2010

- China Stocks Worst Start To A Year Since 2010

- German Stocks Worst Start (In USD Terms) Since 2010

- Global Economic Data Disappointments Worst Since 2012

- Emerging Markets, Gold, Silver Worst Start To A Year Since 2013

- High Yield Bonds Worst Start To A Year Since 2013

- Offshore Yuan Worst Month Since Aug 2015

- Global Bonds Worst Start To A Year Since 2015

- Treasury Yield Curve Down Record 16 Of Last 18 Quarters

We’re off to a great start globally. And to think we started off the year talking about “globally synchronized growth.” That became a joke as soon as the Fed’s Great Unwind started picking up speed.

While I think the tax cuts are just getting up to a speed of their own in the US, I also think the Fed’s next increase in the velocity of unwind will continue to drag on them in a proportional manner that stymies their effectiveness — so all-pervasive is this massive deflationary force. (I’m not speaking here of price deflation, though that could/should eventually follow.) It’s one foot on the gas and one foot on the brakes here in the US.

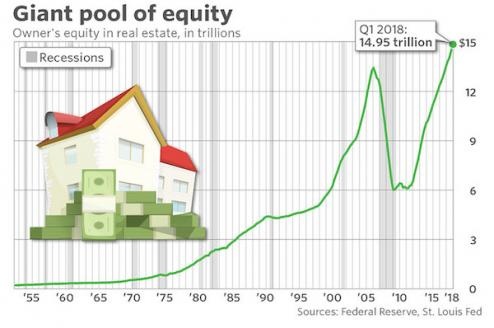

For now, US stocks are badly crippled, and global stocks are dying everywhere. Where you’ll see deflation is exactly where you saw inflation during the Fed’s quantitative easing — stocks and eventually housing prices. That’s what the Fed pumped up; that’s what it is now letting the air back out of (though it mysteriously thinks it can let the air out without deflating the very things its hot air inflated). Go figure.

The Epocalypse that began insidiously in January will become readily apparent this summer. Since summer has just begun, let’s take a look now at whether the next phase of this economic collapse (which I said would unfold slowly but massively like a mountainside that is sluffing away in sections) is looking more likely or less likely. We’ll do that by just recapping recent headlines that reflect economic/market trends:

Headline changes in the economy

Dow May Have Longest Losing Streak Since 1978: “The Dow might be about to suffer its longest losing streak in 40 years. The index has lost eight days in a row, and many of them were punishing. Now, if the Dow loses again today, making it nine days in row, it will be the longest streak since 1978. Since 1896, the Dow has only suffered ten losing streaks of nine days or more.”

Market Update: Volatility Makes a Stunning Return as Trade Risks Sink Global Stocks: “All of Wall Street’s major indexes fell hard in the first session of the week. The large-cap S&P 500 Index declined 1.7% to 2,717.07, with nine of 11 primary sectors finishing lower. Shares of information technology fell the hardest, declining 2.3%.”

Hedge Fund Managers See Echo of Past Crashes in Markets: “The ranks of hedge fund managers expecting impending market chaos are growing. Greg Coffey, the former star manager at Moore Capital Management who started trading at his own firm this year, is comparing the turmoil in May to the end of dotcom bubble in 2000 … join[ing] a growing chorus of investors predicting an end to the decade-old rally in asset prices, as central banks move to normalize policies and the rise of populism threatens trade across the globe. Billionaire George Soros in May warned of a looming financial crisis…. The ghosts of 2000 are upon us.”

How can any equity bull seriously look you in the eye and smile when Financials get hammered 1.3% as they did yesterday, and are in official ‘correction’ terrain? How does that comport with a bullish narrative, ever, considering that Financials are the lifeblood for the economy? (David Rosenberg)

It’s hilarious to read the tweet responses that the USA will win the trade war because the Shanghai index is under performing. Meanwhile, the SPX home builders are down 20%, banks down 13%, the auto stocks down 10%, the Transports down 8%. What a market! (Rosenberg)

The Dow and S&P 500 blow their biggest intraday gain since February: “The Dow Jones Industrial Average on Wednesday relinquished its biggest point gain since February [due to] selling in shares of bank and technology-and-internet companies…. The S&P 500 … also marked its largest blown lead since February…. Wednesday’s reversal comes as trade-related worries have created anxieties among investors fearful that the current tit-for-tat spat between the U.S. and its trade partners China and the European Union morph into a trade war that damages global economies…. The technology-laden Nasdaq Composite Index COMP, -1.54% given the focus on tech, saw a more pronounced tumble.”

Here’s why stock-market investors are so worried about the U.S.-China trade skirmish: “Most investors don’t need a reminder of Beijing’s ability to send ripples through global financial markets via its currency. Less than three years ago, a devaluation of China’s yuan currency, also known as the renminbi, triggered a sharp selloff in global equity markets that also engulfed Wall Street. “I do have concerns that they could do a quick unannounced adjustment and I think that could be very disruptive here, because it was last time.’”

China Has Quietly Implemented A 6% Across The Board ‘Tariff’ On All US Imports: “Since Trump started to rattle his trade war sabre, the last three months have seen the offshore Chinese Yuan tumble over 6% (crashing almost 4% in the last two weeks alone)…. This massive drop in the value of the Yuan mirrors the violent devaluation, snap in 2015…. All of which suddenly makes US imports to China 6% more expensive than they were in Q1 – a stealth tariff.”

Leaked Note By Chinese Think Tank Warns Of Potential “Financial Panic”: “The Shanghai Composite already tumbled to a bear market from its highs 6 months ago…. Corporate defaults are rising, and the all important credit impulse is waning…. This morning Bloomberg reported of a leaked report from a Chinese government-backed think tank which warned of a potential “financial panic” in the world’s second-largest economy…. The think tank also warned that leveraged purchases of shares – i.e. stocks bought with margin loans – have reached levels last seen in 2015, when a market crash erased $5 trillion of value.”

Chinese Dealmakers Turn to Europe for Takeovers, Drop US for Now: “The rapidly deteriorating trade and investment relationship between Washington and Beijing is sending a further chill through Chinese dealmakers who have already seen the number of Chinese acquisitions of American assets take a big hit…. Chinese companies have spent just $1.6 billion on U.S. assets, down almost 80 percent from the year-earlier period. ‘We are now focusing on Europe-bound deals and having U.S. deals on hold. The trade war between China and U.S., if not short-term, will be a mid-term thing and will take some time to conclude.’”

Stocks end decisively lower as major tech and internet names sell off; indexes close at lowest level of June: “The S&P 500 closed below a closely watched technical level [its 50-day moving average], which could be a sign that the recent weakness in stocks isn’t over yet…. The Dow Jones Industrial Average … closed below its 200-day moving average for a third straight session, a level that is often used a gauge of an asset’s long-term momentum…. The financial sector fell 1.3% in its 13th straight daily decline, extending what had already been the longest losing streak in its history. ‘I think volatility is returning to the U.S. market and that we could see another correction cycle.’”

‘Godfather’ of chart analysis says stock market now dealing with ‘uglier action’: “Prominent market technician Ralph Acampora is growing increasingly concerned about recent moves in the stock market, notably in the Dow Jones Industrial Average…. What he’s observing currently suggests that the bullish dynamic in equities may be unraveling…. The Dow … on Monday closed below its 200-day moving average for the first time since June 2016…. Industrial giant Caterpillar Inc. CAT, -0.69% saw its shares enter bear-market territory on Monday.”

As The Yield Curve Flattens: The U.S. yield curve continues to flatten, with Wednesday seeing new, 11-year low spreads. As you know by now, this has significant long-term implications [of recession…. A new low going back to 2007.”

Manufacturing Sector Growing at Less Robust Pace: “One of the highlights of the current expansion has been the rebound in manufacturing. Well, that upturn may be moderating. Durable goods orders fell in May, marking the second consecutive monthly drop. Declines were pretty much across the board…. Over-Year: -2.2%…. Capital spending also slowed…. While the tax cuts provided the means of invest, firms have not done so consistently as spending has been up and down like a yo-yo this year.”

It Gets Spiky: The Most Splendid Housing Bubbles in America: “Prices of houses and condos across the US surged 6.4% in April from a year earlier … according to the S&P CoreLogic Case-Shiller National Home Price Index…. The index is now 8.8% above the nutty peak of ‘Housing Bubble 1’ in July 2006 … the peak of the definitive housing bubble that then collapsed and helped push the global financial system to the brink.”

Fed Test Fails Deutsche Bank, Forces JPMorgan, Goldman, Four Others to Limit Payouts: “The Fed failed the U.S. subsidiary of Deutsche Bank AG, citing “widespread and critical deficiencies” in its planning, limiting the unit’s ability to send capital home to Germany.

Goldman Sachs Group Inc. and Morgan Stanley — agreed to freeze payouts at previous years’ levels. Both banks were required to rein in their dividend and stock buyback plans after the Fed warned their initial, more bullish, proposals would have left them with inadequate capital buffers.”

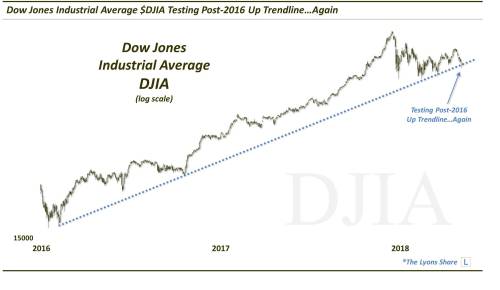

Equity Bull Markets Toeing The (Trend-)Line: Equity indices testing key bull market uptrends. Specifically, several are testing their cyclical bull market Up trendiness. [Meaning testing downward against their strongest line of technical support.] … these ~2-year old trendlines hold considerable significance. They have provided the necessary support to maintain the bull markets’ pace of advance thus far. Therefore, a break of such support would undermine the pace of advance, at a minimum – and potentially subject the markets to meaningful downside pressure…. Several of these trendlines are under siege currently from a number of equity indices, both domestically and abroad…. The fact that we have an abundance of tests underway simultaneously suggests that we’re at another important juncture in the global market — so stay on your toes.

In proof of how significant the late-January/February plunge was …

The stock market is days away from setting a bearish record: “The Dow and S&P 500 are 10 trading days away from their longest corrections since 1984. Both the Dow Jones Industrial Average … and the S&P 500 … have been mired in correction territory for months … when concerns that inflation was returning to the economy sparked a selloff that led to their dropping 10% from record levels hit earlier in the year…. Neither index has been able to fully recover … which is what would be needed for them to exit correction territory.”

Iran sanctions could soon push oil prices above $90 a barrel, Bank of America Merrill Lynch says: “President Donald Trump’s sustained bid to disrupt Iran’s petroleum exports could soon help to push oil prices above $90 a barrel, analysts told CNBC on Thursday…. ‘We are moving into an environment where supply disruptions are visible all over the world… and of course President Trump has been pretty active in trying to isolate Iran and getting U.S. allies not to purchase oil from Iran.’ International benchmark Brent crude traded at around $78.18 on Thursday.”

EPFR: Global Investors Pull $29 Billion Out of Stocks: “Pulling billions out of equities Is the new thing. Sentiment on the stock market has clearly soured lately, as can be seen by the latest EPFR data showing global equities had $29 billion of outflows last week, or the most in 20 weeks. U.S. stocks saw $23.6 billion of outflows.”

Consumer Spending Stalls as Inflation Tops Fed Goal: “U.S. consumer spending rose less than forecast in May as outlays on services fell and Americans saved more of their incomes. Inflation topped the Federal Reserve’s goal by more than expected. Purchases rose 0.2 percent from April … and the Fed’s preferred price gauge rose 2.3 percent from a year earlier.” Adjusted for inflation, consumer spending has stopped growing.

U.S. Public Pension Returns near 3-yr low: The 100 largest U.S. public employee pension systems earned just $14.3 billion on their investments in the first quarter, their worst performance since September 2015, according to new U.S. Census Bureau data. The pension funds’ total assets dipped by $27.8 billion, or 0.7 percent…. The underwhelming first quarter performance was driven by several factors, particularly equity volatility, according to Roy Eappen, a senior analyst at Wells Fargo Securities. It was a stark change from the certainty that prevailed in the fourth quarter of 2017.

Don’t Tell Trump, But The Atlanta & St.Louis Feds Just Slashed Q2 GDP: “Just two days after Donald Trump Jr slammed “the experts” and crowed of expectations for a 4.5% Q2 GDP print, The Atlanta Fed took an ax to its forecast this morning following disappointing spending data… The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2018 is 3.8 percent on June 29, down from 4.5 percent on June 27…. GDPNOW is notoriously over-optimistic and ubiquitously downgraded as the quarter goes on…. And Q1 was a doozy…(remember, Q1 GDP forecast began at 5.376%!! and ended at 2…) And definitely don’t show them the St.Louis Fed GDP Nowcast – it just collapsed from 3.44% to 1.29%!!“

Finally, what does it look like if you combine all the stocks of the world in one chart? It looks almost exactly like the Dow in the chart above, as though all markets are moving in lockstep:

We say that as the ACWI is presently testing the Up trend line … from its 2016 low which connects the lows from Brexit and the U.S. Presidential election as well as those from March-May of this year. Will the trendline hold? Nobody knows, but we do not like the fact that the index has tested the trendline now 4 times in the past 3 months. The risk is that all of those touches have weakened the trendline and left it susceptible to breaking. Should it break, the risk is probably about 6-7% in the near-term. (Zero Hedge)

Volatility along a downslope is the new trend

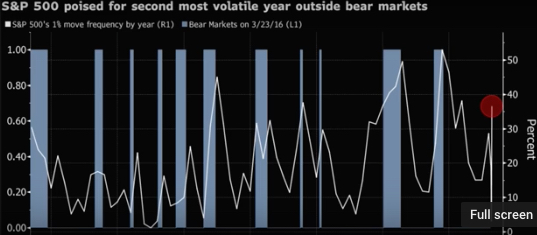

Now, this is interesting: Here’s a look at actual equity volatility (not implied volatility as measured by the VIX) but actual number of days in a year when the S&P 500 moved up or down by more than 1% set against a backdrop of bear-markets. Notice that there is no time on this graph when volatility in the S&P 500 shot up as dramatically as it has so far this year (and the total number of extreme days is far from being in) when we were not in a bear market or did not immediately enter one:

Number of days with stock price movements of 1% or more in the S&P 500.

2018 has also been a ‘different’ year in terms of volatility. As Bloomberg notes, a procession of awful days is battering investor nerves. While most of 2018’s sessions have been up ones, when the market falls, it falls hard. Single-day drops are 20 percent bigger than gains, on average, the widest gap in seven decades…. The average move in the S&P 500 is 0.7 percent this year, up from 0.3 percent in 2017.It’s a pace that if maintained would be the biggest increase on record…. This inability of the S&P 500 to get back to its highs after ‘correcting’ in February – is historic. While an “intermediate correction” is what everyone hoped February’s was (a plunge that never gets worse than about 12%), the odds of it being one of those are shrinking. Of 33 such episodes over the last 70 years, only one has taken longer to erase. (Zero Hedge)

Volatility didn’t shoot up this much for every bear market, but every time it did shoot up this much we were either in a bear market at the point where volatility started to rise, or we quickly entered one. It would be a absolute anomaly if we had this many extreme up or down days (especially being only halfway through the year) and did not rapidly enter a bear market (or find that the downturn that began in January IS a bear market, given more time to run deeper. If the year maintains ups and downs at this rate, it will be the highest peak on the graph.

Don’t tell me that things didn’t break in January. For a year with record stock buybacks and record tax breaks and a unique one-time repatriation of years of foreign profits at low tax rates accompanied by near-record government spending (fiscal stimulus) … 2018 is looking downright abysmal!

My point is not that all trends have turned downward. I could quote other headlines of the past week or two that show positive economic news. My point is that several major and important trends have turned sour since January. Zero Hedge summed up the early summer’s indications of a global downturn this way:

Deutsche Bank plunge[d] to new all time lows dragging down European banks … trade war fears have sent Chinese tech stocks and European automotive names tumbling … the Shanghai Composite enter[ed] a bear market and the yield on the 10Y flash crash[ed] … Emerging Market bonds, currencies and stocks have been pulverized alongside the soaring dollar and oil forc[ed] central bank interventions by the likes of China, India, and Brazil…. “Earlier this week, we put forth the belief that ‘long onlys’ had an incentive to trim momentum exposure and possibly increase cash or risk aversion assets. Currently, it doesn’t feel like it can happen fast enough.“

And that’s just the summer onramp. We haven’t even gotten to the Fed’s 25% increase in its rate of unwind, which will show up later in July. With one exception, every time the Fed has done a little quantitative tightening — even when there was no increase in the rate of unwind — the S&P 500 has fallen by 0.5% or more … up to 2%. So, buckle up! The road ahead is rough, and the Fed is sucking the air out of the tires.